- Semiconductors are the bedrock of the digital economy, core enablers of the data revolution and at the forefront of technological innovation.

- The semiconductor industry could be set for exponential growth driven by the mega forces of AI and digitalization, as well as those of geopolitics and economic competition.

- Investors looking to gain semiconductor exposure may want to consider ETFs that target the entire semiconductor value chain, including companies focused on the design, fabrication, and assembly of semiconductors.

Chip away towards tomorrow: Investing in semiconductors

Sep 14, 2023 Equity

KEY TAKEAWAYS

MEET SEMICONDUCTORS – THE UNSUNG HEROES OF MODERN ELECTRONICS

Semiconductors, also known as integrated circuits (ICs) or “chips”, are mini marvels that pack billions of electronic pieces into a tiny space, just a few millimeters square.1 Semis are born from pure elements like silicon or germanium, or compounds such as gallium arsenide, and then treated through a chemical process known as “doping” that enhance conductivity. These chips perch on wafer-thin stages where their properties of conduction (like metals) and insulation (like rubber), let them steer electrical signals to lay the cornerstones of today's tech revolution.

Semiconductor industry overview

Source: Samsung. "Foundry? Fabless? Learn about the Semiconductor Ecosystem All at Once!" 2/14/2020.

Image description: Illustration of the three production steps of semiconductors: design, fabrication, and assembly. Semiconductor firms, known as integrated device manufacturers (IDMs) perform all three production steps in-house, while there are other firms who specialize in a single step. Companies centered on design alone are termed "fabless", as they do not fabricate chips and instead rely on design software and intellectual property blocks. Companies that focus on manufacturing are called “foundries”, crafting chips using equipment, chemicals, and wafers. Fabless firms closely partner with foundries to create chips, followed by testing and assembly — overseen either by the foundries themselves or outsourced semiconductor assembly and test (OSAT) companies.

Before we dive into the intricate world of semiconductors, here is a quick primer on the various types of firms involved in the manufacturing process, which spans four to six months:2

- Integrated device manufacturers (IDMs) perform all three steps in semiconductor manufacturing: design, fabrication, and assembly.

- “Fabless” firms center on design only; they do not fabricate chips and instead rely on design software and intellectual property blocks.

- “Foundries” focus on manufacturing, crafting chips using equipment, chemicals, and wafers. (Fabless firms closely partner with foundries to create chips, followed by testing and assembly — overseen either by the foundries themselves or outsourced semiconductor assembly and test (OSAT) companies.)

There are four main types of semiconductors in terms of functionality

| Type | Description | Application |

|---|---|---|

| Logic chips | The “brains” of electronic devices — they process digital information to complete a task. There are two types of logic chips:

| CPUs excel at general computing tasks like running operating systems and managing user interactions, while GPUs are efficient for data heavy processing such as natural language processing and AI training. |

| Memory chips | Information-storing chips. There are two types of memory chips:

| DRAM chips are used for quick data access, often as the main memory in computers, while NAND Flash chips are used for long-term data storage in devices like solid-state drives (SSDs), and USB drives. |

| Application-specific integrated chips (ASICs) | ASICs are simple, single-purpose chips used for performing repetitive processing routines. | ASICs are used in scanning a barcode, processing medical image data, and handling high-frequency financial transactions all in real time. |

| System-on-a-chip devices (SoCs) | SoCs are integrator chips that combine characteristics of logic chips, memory chips and ASICs in a single chip. | SoCs may integrate things such as graphics, audio, camera, video, and Wi-Fi, widely used in smartphones, tablets, gaming consoles, and smart TVs. |

THE SEMICONDUCTOR INDUSTRY IS RAPIDLY GROWING

In the past half century, semiconductors have facilitated the evolution from mainframe computers to personal computers (PCs) in the 1990s, crafted internet architecture in the 2000s, and gifted us smartphones in the 2010s. Today, they power everyday gadgets and cutting-edge tech like artificial intelligence (AI), 5G, and electric vehicles (EVs), resulting in a secular demand surge. Fueled by the convergence of AI-driven innovations and increased government spending, semiconductors hold the key to reshaping our future — generating exciting potential opportunities for investors.4

Global semiconductor market value by vertical, $B

Source: McKinsey. “The semiconductor decade: A trillion-dollar industry”, 04/01/2022. There is no guarantee these forecasts come to pass.

Chart description: Bar chart showing that by McKinsey estimates, the global semiconductor industry is projected to become a trillion-dollar industry by 2030, largely driven by the automotive, data storage, and wireless segments.

With chip demand set to rise over the coming decade, the global semiconductor industry is projected to hit the trillion-dollar mark by 2030.3 Nearly 70% of this growth is expected to be driven by three segments:4

Computation and data storage

Propelled by the need for servers to fuel cloud computing and the AI boom. By enabling quicker responses and better language understanding, GPUs are instrumental in powering generative AI breakthroughs like ChatGPT, which crossed one million users within just five days of launch.5 Nearly $16 billion dollars’ worth of GPUs went into AI-related use cases worldwide in 2022.6

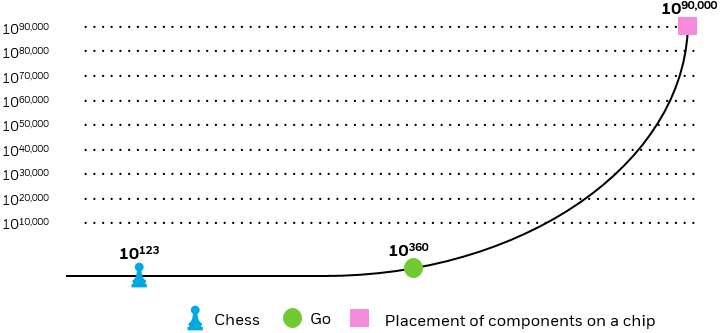

AI is not just reaping the benefits of semiconductor power; semiconductor power is also set to reap the benefits of AI. AI’s use from chip designs to identifying defects, optimizing processes, and even foreseeing chip failures will be transformative. If you thought seeing AI beat a human at chess or Go, one of the most complex games devised by man, was impressive, wait until you see it design a chip. With an astronomical number of potential chip configurations far surpassing the permutation of Chess and Go, AI’s knack for chip design is a game-changer, birthing a new chip era.

Chips have exponentially more configurations than Chess or Go

Source: Deloitte. “Technology, Media, and Telecommunications Predictions”, February 2023.

Chart description: AI once defeated the human champion in the strategy board game Go, which is more complicated than chess and was thought to be beyond AI’s abilities. As illustrated in the graph above, physical chip designs have exponentially more possible configurations than either chess or Go. With the advancement of AI technology, AI turns physical chip design into a graph optimization “game" and autonomously generates superior chip design.

Automotive

Projected to see a tripling of demand driven by EVs. Advances in semiconductors have enhanced EV battery capacity, letting them zoom longer on a single charge. In fact, the total value of semiconductors utilized in an electric car is more than twice that of a conventional internal combustion engine.8

Wireless

Forecasted to account for 25% of semiconductor industry growth over the next decade.9 Semiconductors enable the processing and transmission of signals in devices like smartphones and reduce latency in 5G networks, allowing real-time applications like augmented reality, virtual reality, and remote surgery to flourish.

THE REWIRING OF SEMICONDUCTOR SUPPLY CHAIN CAN SPUR INVESTMENT OPPORTUNITIES

The need for deep technical know-how and high economies of scale in semiconductor design and fabrication has resulted in a highly specialized global supply chain. For example, East Asia, particularly Taiwan, excels in wafer fabrication and assembly, while the U.S. and Europe specialize in research-intensive activities such as chip design and advanced manufacturing equipment. Every region is interdependent: the typical semiconductor production process involves steps in more than five countries and three or more shipments across the globe.

However, the fragility of the semiconductor supply chain was highlighted by the COVID-19 pandemic and is increasingly being impacted by geopolitical competition. These tiny chips now hold major sway in a high-stakes economic and military contest, most notably in the rivalry between the U.S. and China. The U.S. barred its companies from selling semiconductors and relevant equipment to China, urging allies like Japan and Netherlands to follow.10 This has limited advanced chip machinery exports, including the vital lithography equipment for cutting-edge microchips that power AI.11 China countered by limiting exports of gallium and germanium — rare metals needed for manufacturing semiconductors with critical use cases in missile defense systems and military applications such as satellites, radar and night-vision devices.12 China produces 60% of the world’s germanium and 80% of gallium, and currently provides around half of U.S. supplies.13,14

As we enter a new era of global fragmentation with rewired supply chains, policymakers worldwide are doubling down on boosting domestic chip industries and incentivizing firms to expand local manufacturing and design with subsidies and tax breaks. The U.S. and Europe, for instance, are seeking semiconductor self-reliance:15,16

~ $53B

From the CHIPS and Science Act in the U.S. was provided to support local American semiconductor research, development, manufacturing, and workforce development, which will lead to the geographical realignment of manufacturing capacity.

~ €43B

From the CHIPS Act in the E.U. was provided to develop more fabs and increase semiconductor production in the region, with an aim to double the EU’s global market share from 10% to 20% by 2030.

WAYS TO CONSIDER INVESTING IN SEMICONDUCTORS

The chips arms race, intensified by widespread AI adoption, adds an exhilarating dimension to semiconductor investments across the globe. Investors seeking exposure to the semiconductor industry may want to consider ETFs that target the full value chain including companies that design, fabricate, and assemble semiconductors.

CONCLUSION

Chips are the new bricks

Semiconductors, the building blocks that power the EV boom and the AI revolution, have enabled breakthrough innovation in virtually all areas of society, and fundamentally shifted the boundary between the possible and the impossible. In this increasingly fragmenting world, semiconductor companies stand to benefit from a ramp-up of government investments, bolstering supply and driving innovation for decades come.