Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

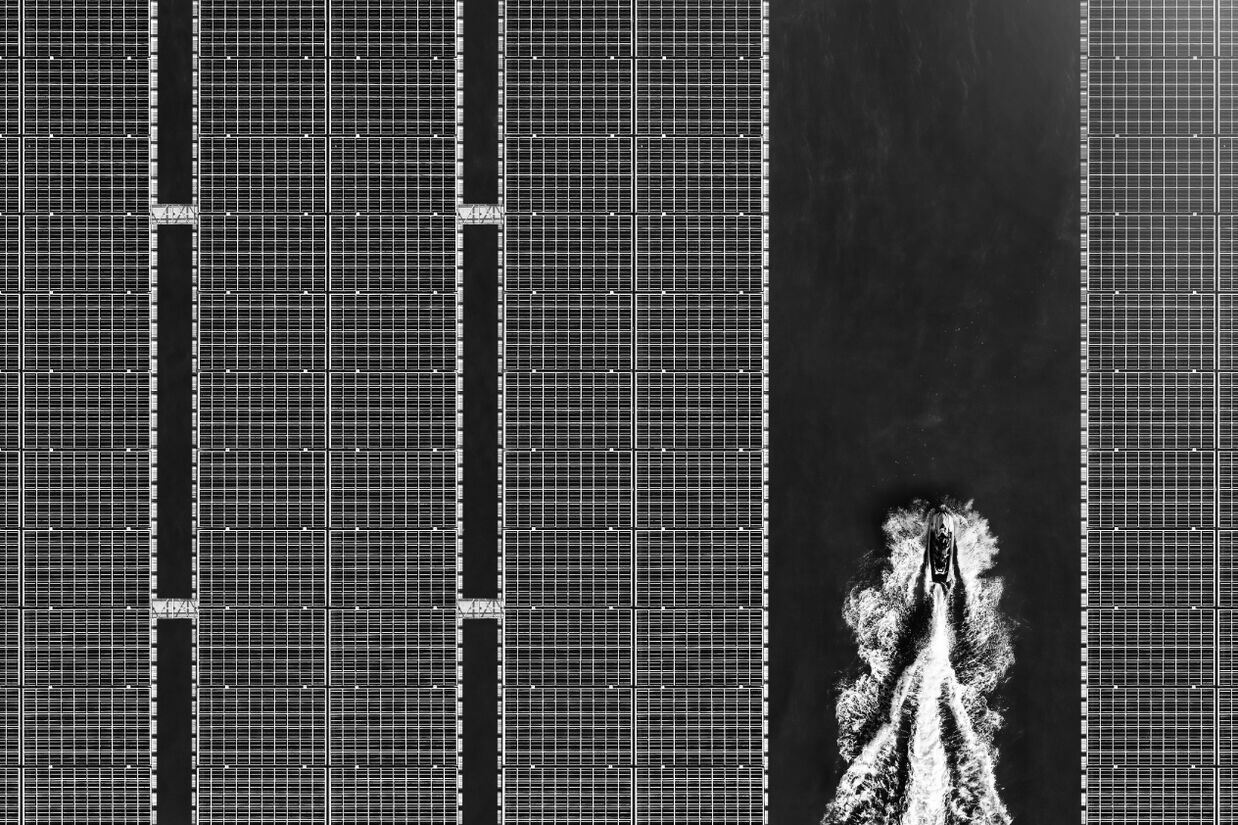

WHY CLIMATE TRANSITION AWARE ETFs?

Many companies in higher emitting sectors are undergoing transformations,1 and their efforts play a critical role in the process of decarbonisation. Investors looking to access companies invested in the transition to a low-carbon economy can now get exposure to companies with credible emissions targets.

Incorporating a forward-looking approach to metrics, iShares MSCI Climate Transition Aware ETFs can help investors access companies with credible science-based targets, who are involved in the transition to a low carbon economy with sector neutrality.

Through these building blocks, investors can:

- Access companies with Science Based Targets (SBTi)

- Access companies with green revenues as defined by MSCI.2

- Access companies with emissions reductions targets.

EXPLORE iSHARES CLIMATE TRANSITION AWARE FUND RANGE

iShares offers a range of ETFs providing investors with choice to align to their investment objectives.

iShares MSCI Climate Transition Aware ETFs range can help investors access broad building blocks for their portfolio, incorporating forward-looking metrics, while staying close to traditional benchmarks.

The iShares Climate Transition Aware ETF range includes the following funds across a variety of different exposures. The ETF range includes:

After applying exclusionary screens, the MSCI Transition Aware Select Indices are constructed from the Parent Index by excluding securities of companies based on the following exclusion criteria:

Forward looking metrics

The indices provide a defined pathway for investors to reduce their portfolio carbon emissions, selecting companies with approved science-based targets (SBTI) to help future-proof business growth.

Green revenues

The indices look at companies involved in the transition to a low carbon economy and select those that derive a portion of their revenues from activities with environmental impact themes including energy efficiency.

Emissions reductions targets

The indices rank companies with emissions reduction targets within each Global Industry Classification Standard (GICS) sector by carbon emissions intensity and selects the top 50%.3

At BlackRock, we define transition investing as: Investing with a focus on preparing for, being aligned to, benefitting from and/or contributing to the transition to a low-carbon economy.

Through iShares, professional clients have a partner who can bring together choice across a variety of strategies across global and regional products, investor-informed analytics and BlackRock expertise.

Choice

At iShares, we provide investors looking to incorporate sustainability and/or transition-related considerations into the portfolio with choice across the iShares ETF platform. With over US$873B in AUM in Europe, iShares’ scale provides investors with a range of products across asset classes and themes.4

Innovation

We’re constantly innovating to enable our ETFs to expand across the world of investments. iShares innovates for and with its professional clients – like the Climate Transition Aware range, we work with index providers to develop new strategies and unlock new potential opportunities for investors.

Expertise

iShares can leverage BlackRock expertise when helping investors consider climate risk and seek to capture opportunities for portfolios. Our team of in-house specialists, including sector specialists and climate scientists, uncovers insights that empower investment decisions.