HOW TO BUY iSHARES ETFs

Capital at risk. The value of investments and the income from them can fall as well as rise and are not guaranteed. Investors may not get back the amount originally invested.

iShares ETFs

iShares ETFs cover a wide range of asset classes and markets and can be bought and sold via regulated stock exchanges just like individual shares, making them a useful building block for use within your investment portfolio. They can also be used as part of a tax wrapper such as an ISA, SIPP, GIA or offshore bond.

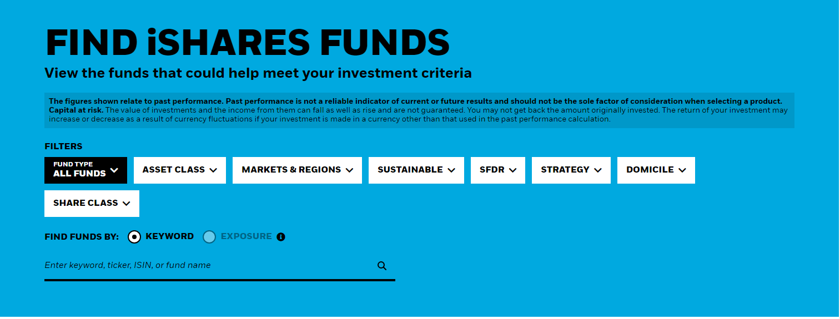

You can explore the full range of iShares ETFs on our intuitive product finder tool, where you can find an overview of each fund as well as key facts, performance and all associated fees.

Once you have chosen the ETF which suits your client’s needs there are a few ways you can buy them, as explained below:

Two ways to buyClick on the individual icons to find out more. |

|||

Execution-only platforms |

Stockbrokers |

||

|

Stockbrokers |

| A stockbroker is a professional who buys and sells securities such as ETFs on a stock exchange on behalf of clients. You can buy iShares ETFs through a stockbroker during daily trading hours. Please note that brokerage and other fees may apply. |

| The London Stock Exchange (LSE) has a tool to help you locate a stockbroker which you can access here. |

Explore bond investing

Discover how bond ETFs can help you navigate today’s market challenges.

Learn more about iShares ETFs

We believe in the power of choice and are committed to providing access to nearly every corner of the market through our ETFs.