1. BONDS ON SPRING BREAK

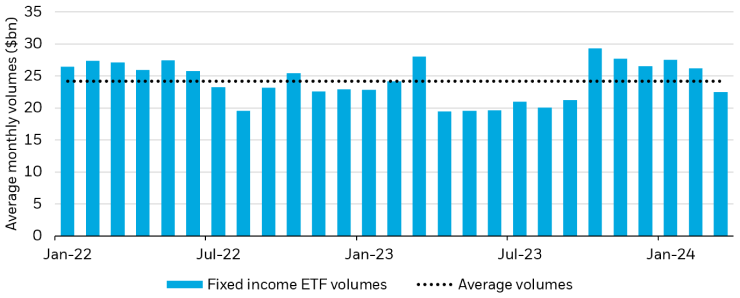

Fixed income ETFs logged a notable decline in volumes in March, averaging $22.5bn traded daily, its lowest level since September. Fixed income ETF share of total equity trading sank to its smallest percentage in 27 months (December 2021, for the finger-counting readers).1 This downtick was fixed income specific – equity ETF volumes chugged along, up on the margin month-over-month and above their historic averages.2

Subdued volumes translated to subdued flows: while equity flows tend to outnumber their fixed income counterparts, that ratio hovers typically around a 30% to 70% split.3 In March, that proportion dipped to 18% fixed income, and 82% equity.

Broad allocations led inflows, with credit exposures as the second largest asset gatherer.4 Despite strong performance in the high yield market, HY ETFs saw outflows on the month. Duration preferences underscored a similar divergence between flows and performance: intermediate Treasuries added inflows while the front end of the curve saw sharp outflows, to the tune of $2.7bn, even on the heels of narrow outperformance.5