1. STAYING INVESTED HAS BEEN MORE IMPORTANT THAN WHO WINS

Markets don’t vote in elections, but they do vote with their feet. And in that regard, they are strictly non-partisan. While party jostling may dominate headlines, historically markets have continued to march higher regardless of who holds power.

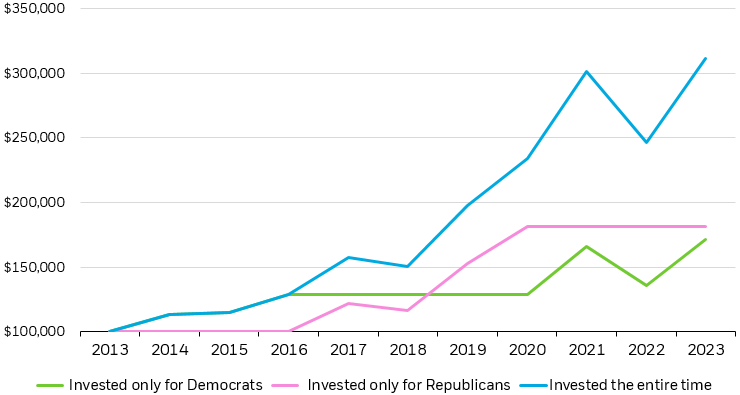

Under the hood, party control may influence sector and industry performance, but at the broad index level staying invested has been more important than which party holds the presidency.1 Consider two horizons: over the last ten years, money invested only under Republican presidents returned slightly more than money invested during Democratic reign. But by far the winning investment strategy was to stay invested, even as political power changed hands. Investors who held the course as political winds changed earned nearly twice as much in the last decade as those who plumped purely for their party (Figure 1).

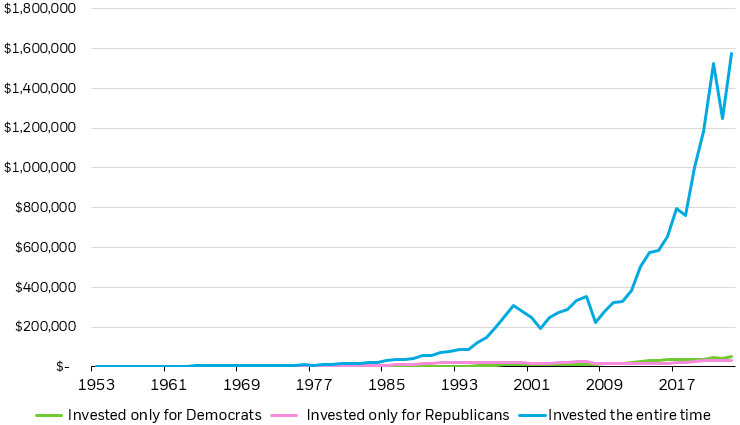

Over the very long term the same is true, but at much greater magnitude. Over the last 70 years, market performance during Democratic presidencies edged out their Republican counterparts. But bipartisan investors took home the real prize, earnings 31x more than the party faithful (Figure 1).

Index investing can be a good way to diversify company specific risk, as elections can benefit some and not others, but are notoriously hard to predict. Rather than selecting funds with exposures tied to the fate of a single party, investors may consider allocating to a diversified basket of high-quality companies that have been shown to stand the test of time — regardless of who’s in power.