GROUNDHOG MAY: INVESTORS CONTINUE TO FAVOR HIGH-QUALITY EXPOSURES ACROSS EQUITY & BOND ALLOCATIONS

May’s market moves were largely emblematic of YTD trends: tech juggernauts continued to dwarf other industries, leading broad market gains, offset by drags from eight of the other S&P 500 sectors. This tech optimism was reflected in flows, and the sector notched its highest week of inflows in 17 months.1

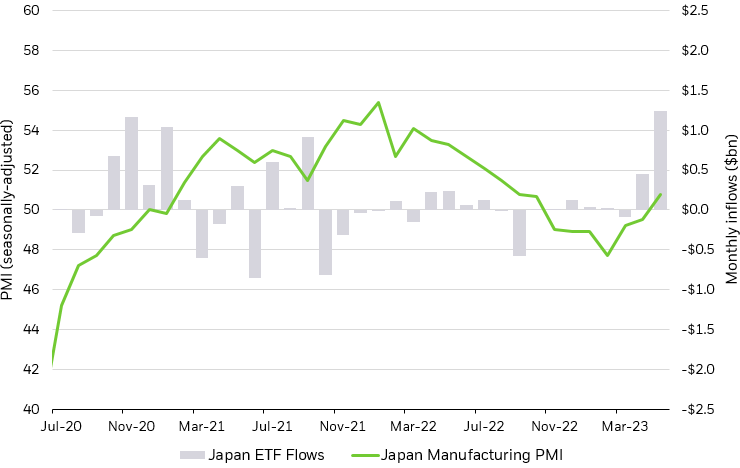

Elsewhere, weak economic data at home sent investors shopping abroad — Japan ETFs netted inflows as the Nikkei 225, the Tokyo Stock Exchange’s analog, hit 33-year highs.2 Fixed income investors continued to lean into broad, investment-grade exposures.