Hi, I’m Gargi Chaudhuri, Chief Investment and Portfolio Strategist for the Americas for BlackRock. The team and I just published our Spring 2024 Investment directions and I'm so excited to discuss it with you. So let's begin.

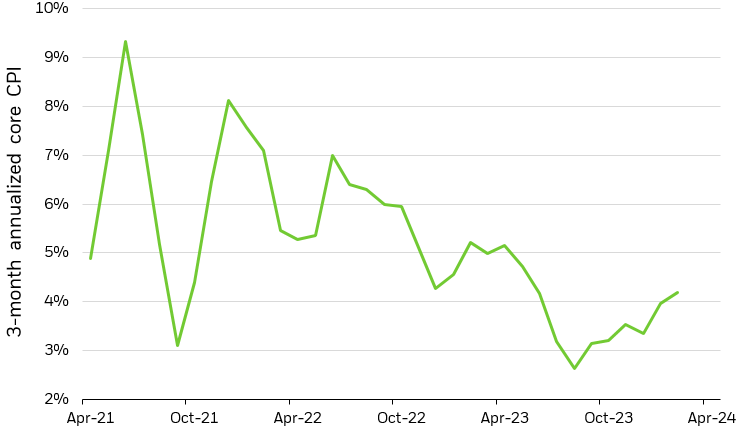

The U.S. economy has evolved since our last report earlier this year. Inflation remains stubbornly above the Fed’s target of 2% and although economic growth is slowing, it remains firmly solid, thanks in part to a robust consumer.

We hold our view that the Fed will deliver three policy rate cuts before the end of the year. However, somewhat different from before, is that the risk of only two cuts appears higher to us than the risk of four or more. The Fed will need to navigate cautiously and they need to find greater confidence on the trajectory of inflation - before it begins its cutting cycle.

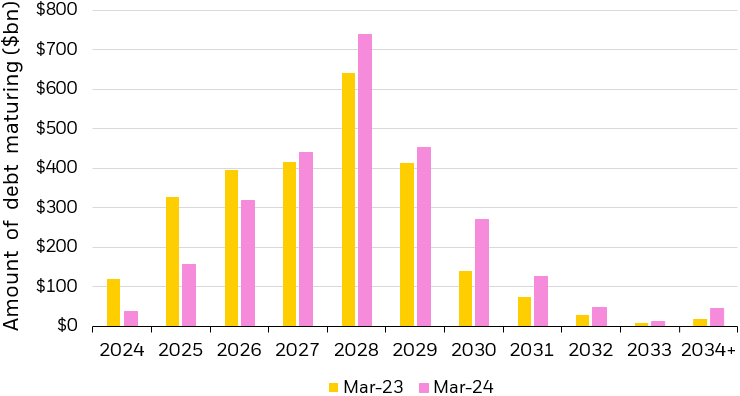

Consistent with higher short-term rates, as of March, money market fund assets have surged to above $6 trillion, which is at an all-time high, but we believe cash returns are set to decline once the Fed begins its rate cutting cycle. Investors should consider stepping away from the sidelines to seek upside potential find opportunities in fixed income. Income-oriented investors could take advantage of these opportunities by allocating to the 3–7-year segment of the yield curve as well as short-term investment grade credit.

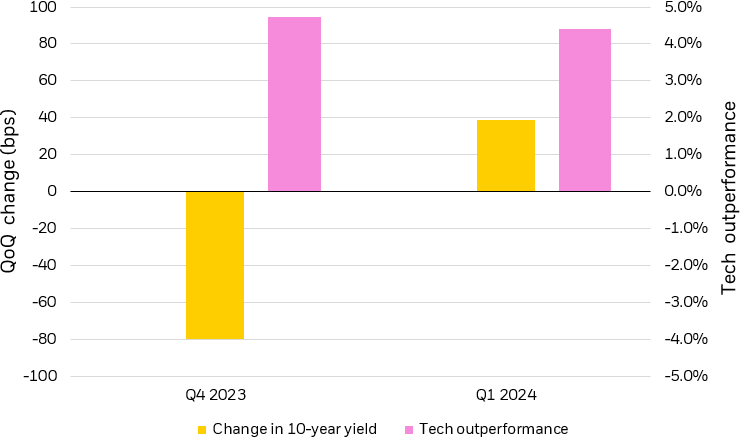

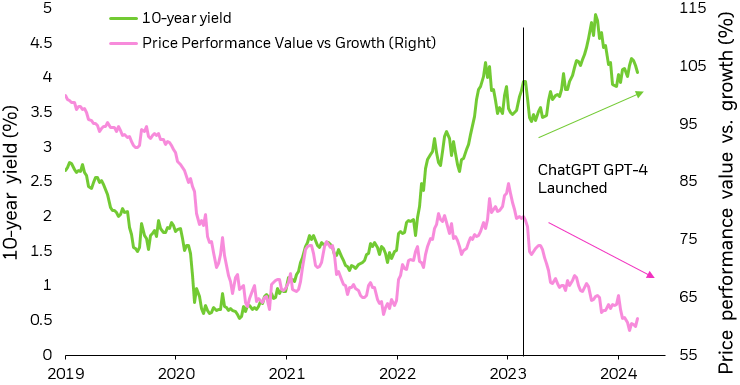

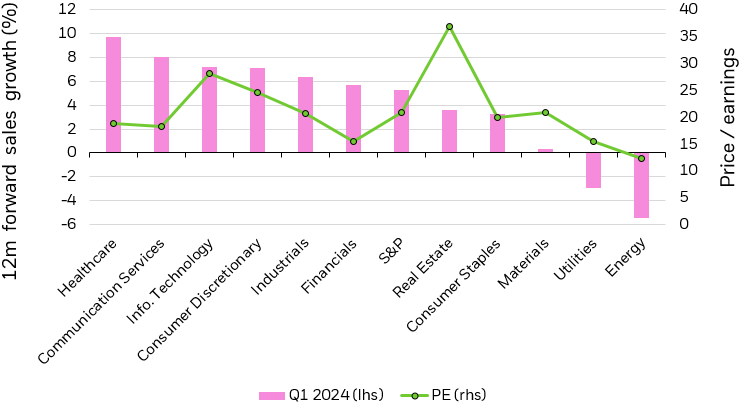

Within equities, investors could consider broad-based exposures and taking selective risks in high-quality assets. We like specific sectors, such as financials and communications, and these stand out as investors look to add granularity to diversified portfolios.

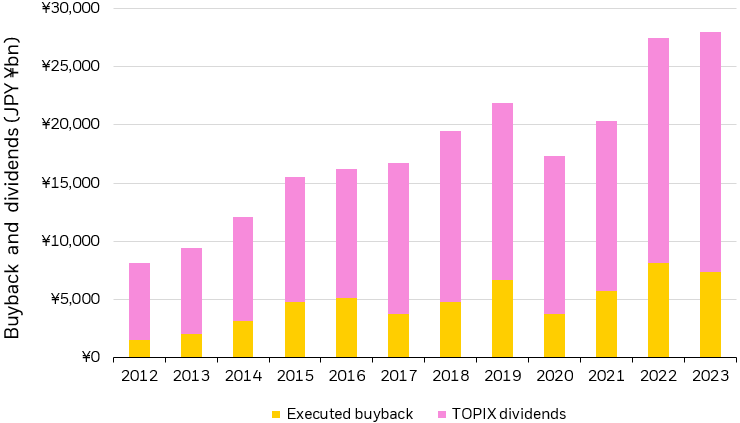

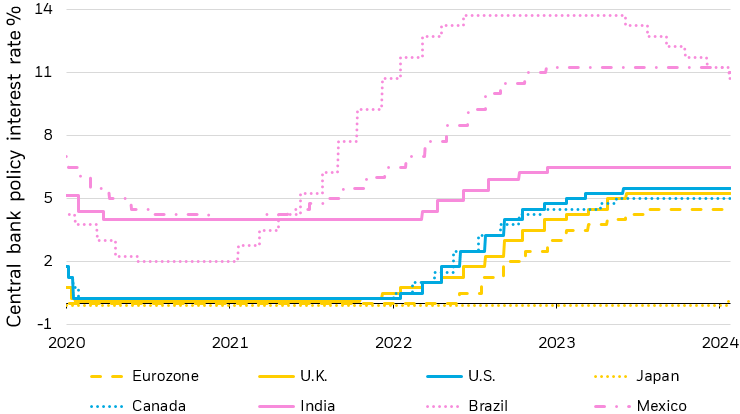

Finally, looking abroad, investors could find selective opportunities in emerging markets through single-country exposures such as Japan and India, and by differentiating between regions whose central banks have begun easing policy versus those that have not. We also encourage investors to focus on structural shifts such as the themes of reshoring and infrastructure.

To read more into our views and our product recommendations, visit iShares.com to read our full Investment Directions. Thank you and speak to you soon!

Disclosures:

Source: Long term Fed inflation target from Summary of Economic Projections. Economic growth and consumer robustness from Bloomberg. As of March 28, 2024.

Source: Money market data from EPFR, Markit. Money market fund grouping determined by Markit. As of March 22, 2024.

Past performance does not guarantee future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material contains general information only and does not take into account an individual‘s financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. This material does not constitute any specific legal, tax or accounting advice. please consult with qualified professionals for this type of advice.

Prepared by BlackRock Investments, LLC, member FINRA.

©2024 BlackRock, Inc. or its affiliates. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc. or its affiliates. All other marks are the property of their respective owners.

iCRMH0424U/S-3418557