Hi, I’m Kristy Akullian here with 5 key takeaways from our 2025 market outlook.

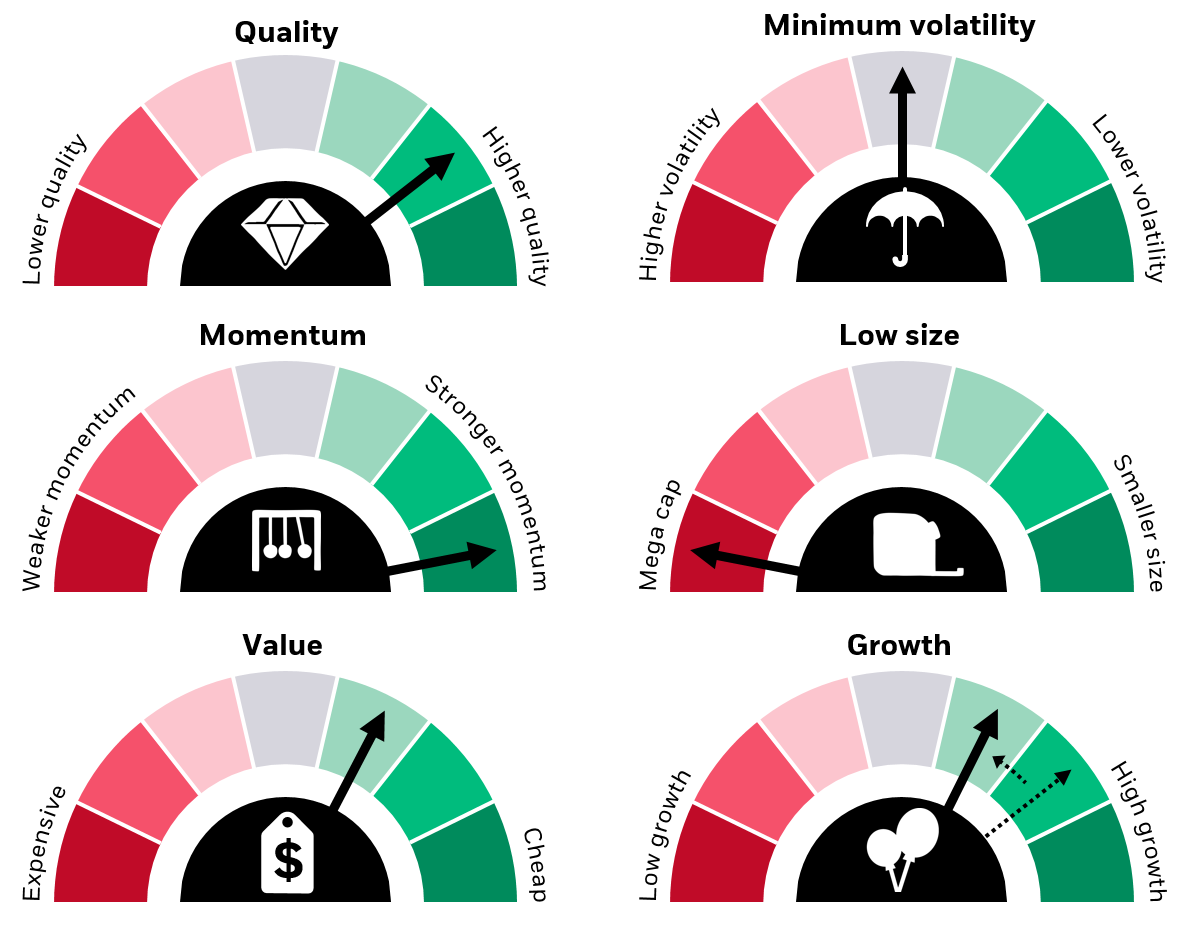

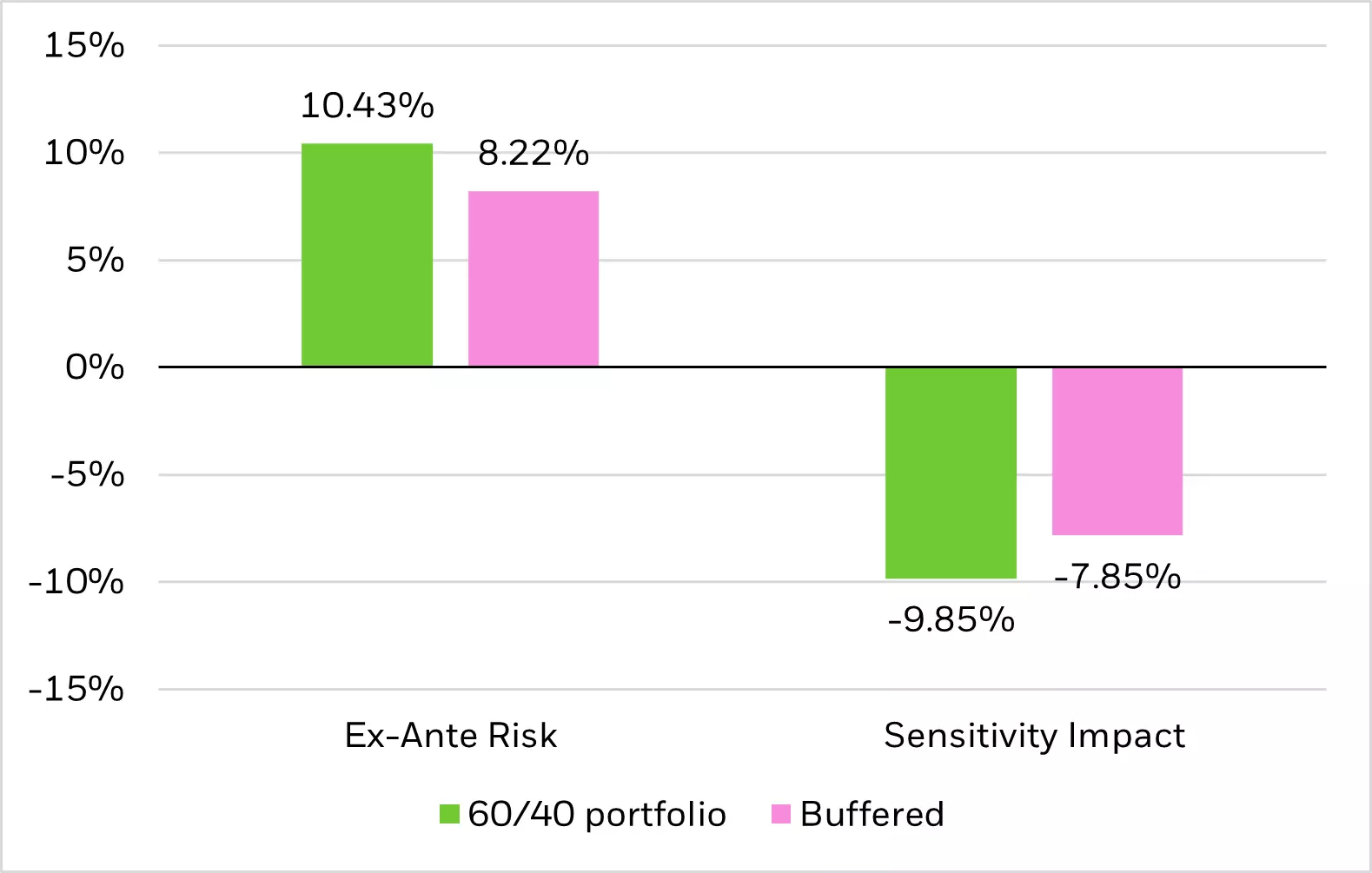

Heading into 2025, we’re taking a pro-risk stance at the macro level.

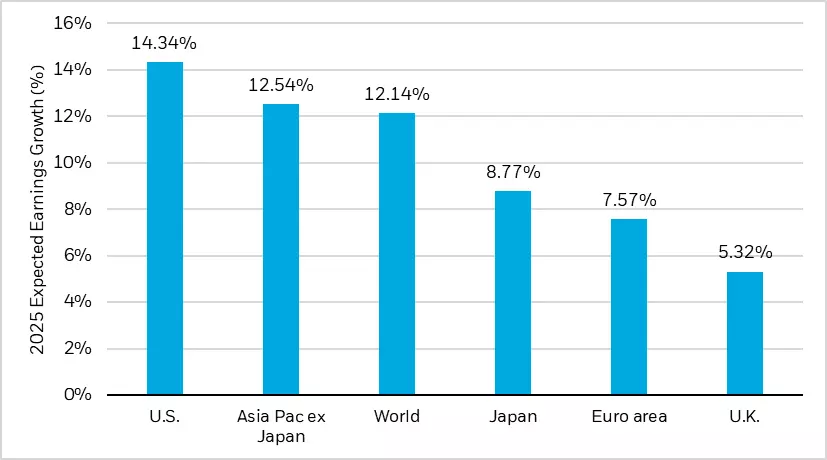

We see tailwinds potentially favoring US equities over the rest of the world, particularly large-cap companies.

Despite last year’s US exceptionalism, we believe selective international exposure can provide potential diversification and differentiated returns.

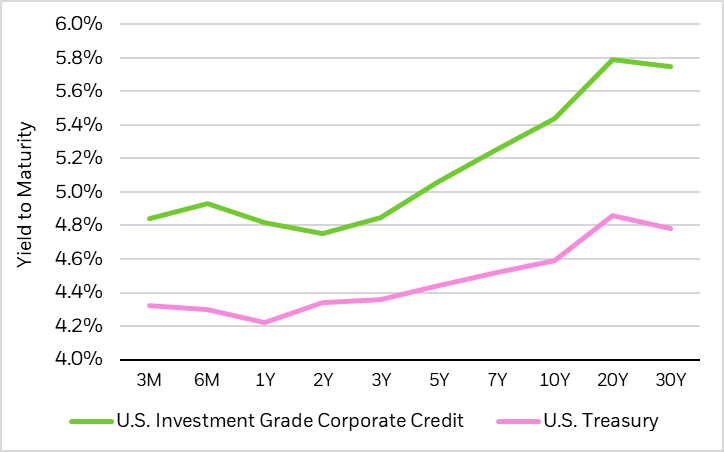

In fixed income, we prefer short to medium term maturities over long duration exposures.

But, trade and immigration policy uncertainties could pose risks to growth or inflation.

Our full report dives deeper into these themes and our asset class views, along with actionable portfolio ideas and potential ways to hedge against these risks. Head over to iShares.com to read our whole 2025 Year Ahead Investment Directions!

Thank you for watching.

Disclosures:

Source: US. exceptionalism represented by S&P 500 index total returns and US. economic growth.

Past performance does not guarantee future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable. are not necessarily all-inclusive and are not guaranteed as to accuracy. As such. no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock, its officers, employees or agents. This material may contain “forward-looking” information that is not purely historical in nature. Such information may include. among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. This material does not constitute any specific legal. tax or accounting advice. Please consult with qualified professionals for this type of advice.

Prepared by BlackRock Investments, LLC, member FINRA.

©2025 BlackRock, Inc or its affiliates. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc. or its affiliates. All other marks are the property of their respective owners.

iCRMHOlZSU/S-4138665