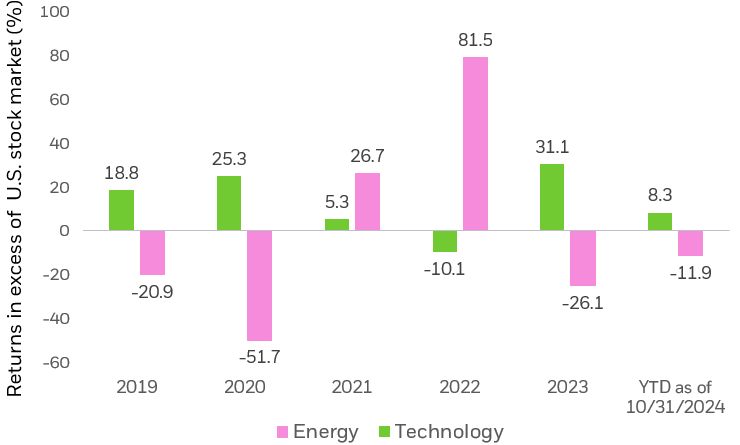

Historians, economists, and social scientists will long study the last decade for lessons on human behavior. For the average investor, though, a key lesson already stands out: There’s wisdom in diversification.

Diversification is the practice of not holding all your eggs in one basket, thereby owning a mix of stocks with different business activities, as well as other investments like bonds. This cornerstone investment principle was born in the 1950s, helped spur the advent of index mutual funds in the 1970s, then drove the rise of index-tracking exchange traded funds (ETFs) starting in the 1990s.1

Index funds give all investors simple and low-cost access to diversified investment strategies and, in recent decades, helped individuals move from owning individual stocks, which bring with them unique and concentrated risks, to increasingly global strategies spanning stocks, bonds and more. Take iShares Core ETFs as an example, which allow investors to build a low cost, diversified portfolio with as little as one fund.

So, what has diversification and index funds done for investors recently?