During your working years, especially in your younger years, experts recommend investing for growth when major swings in the stock market are less concerning, because your portfolio has time to recover. In retirement, when you rely on these investments for regular spending, experts recommend investing in more mature assets because wild swings in value can leave a long-lasting mark and potentially derail your retirement plans. The transition from growth to income should be a gradual process that focuses on increasing diversification to help reduce large swings in the value of your investments. This means shifting a portion of your investments from growth-oriented stocks to more mature assets, often in the form of dividend stocks, bonds and other investments with low correlation to high growth stocks. Think of it as tuning your engine from speed to fuel-efficiency.

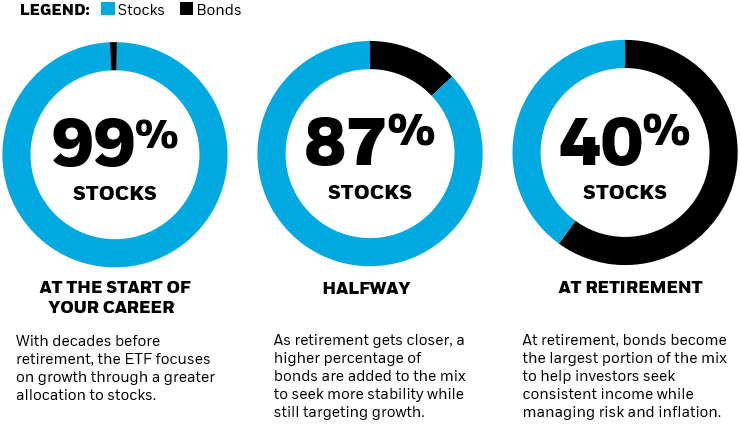

With the iShares LifePath Target Date retirement ETFs navigating this transition becomes easier. The ETFs are managed by a team of investment professionals and designed to automatically take more risk early on and gradually become more conservative as the target retirement date approaches. The result? Funds that seek the right risk at the right time, from retirement investing to retirement income. No need to make any changes, even in retirement. See below for how iShares Target Date ETFs evolve, adjusting the mix of your retirement portfolio adjustments for you, so you don’t have to.