HOW DOES IT WORK?

Investing for retirement is rarely a straight line from first investment to retirement freedom—shifts in the stock market, inflation and an evolving ability to take risks are just a few of the twists and turns retirement savers might encounter.

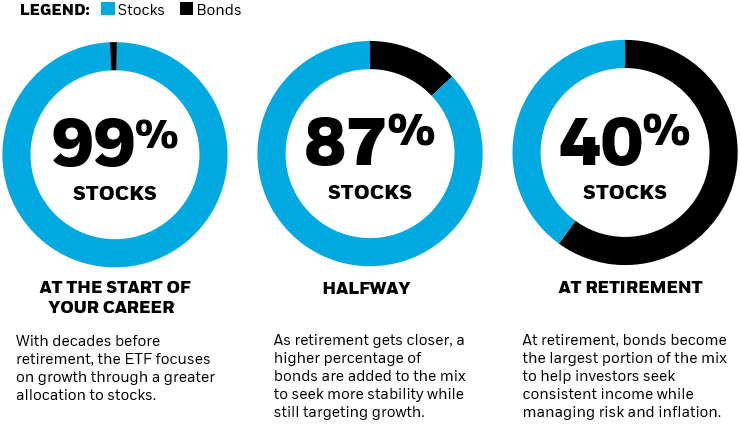

In a target date ETF, a team of investment professionals guide the portfolio toward its target retirement date by reducing risk over time through adjustments to the fund’s underlying mix of stock and bond ETFs.

iShares LifePath Target Date ETFs make it easy to navigate towards retirement by leveraging BlackRock's 30 years of experience managing retirement solutions. Simply select the fund closest to your ‘target date’ — the year you plan to retire. Over time, the LifePath Investments team will slowly change the mix of global stocks and bonds to reduce risk exposure as the target date approaches.