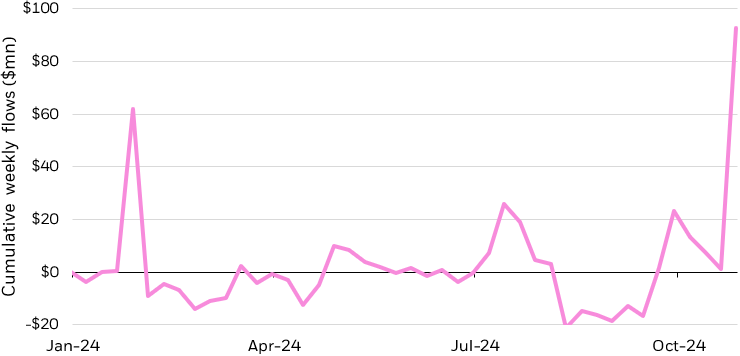

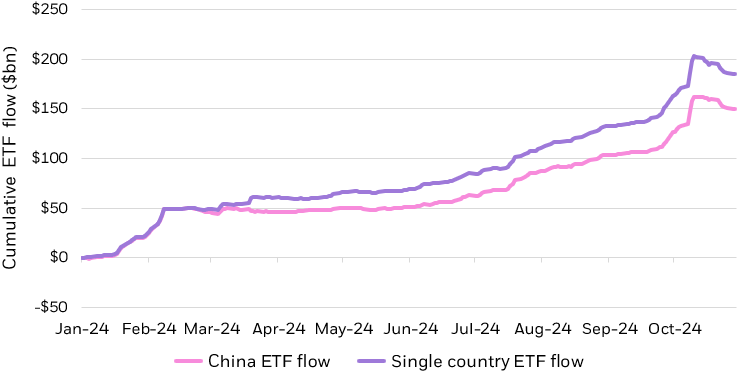

October marked a notable divergence from 2024 trends in international fund flows, exacerbated by disappointment from China’s policy updates. At the end of September and beginning of October, single country China ETFs garnered investor attention when the Chinese government enacted surprise stimulus to buoy economic activity. While the supportive policies boosted short-term performance, the lack of meaningful follow through by the government led to Chinese equities losing ~4% in October.5 Flows in Chinese single-country ETFs have followed performance and shed $10bn from October 12th to 26th, a fourth of the inflows that followed the initial surprise policy shift.

Outflows from China focused-ETFs intensified the broad outflows from single-country allocations, which were occurring for the first time this year. From mid-April to the start of October, single country funds notched $134bn in inflows.6 Over the past two weeks, however, China outflows have contributed to $16bn in outflows from single country allocations.7