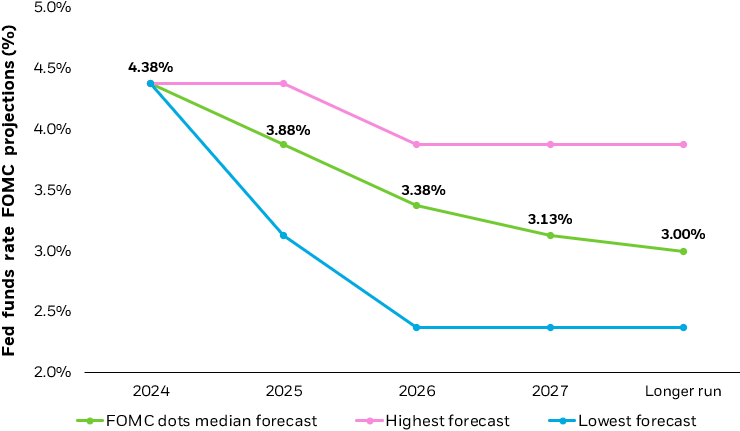

Looking out into 2025, we believe the most likely path is for the Fed to bring rates down to around 4% in the coming meetings, and then pause, depending on how the inflation and employment data evolves.

Why is that our base case for 2025? As of November 2024, the U.S. Core Personal Consumption Expenditures (PCE) Price Index was up 2.8% on an annualized basis.3 While that’s down from a rate of 3.4% a year prior, it’s still above the Fed’s stated 2% target.

“We’ve made a great deal of progress” in lowering inflation toward the 2% target, but year-over-year inflation readings are “moving sideways,” Federal Reserve Chairman Jay Powell said in a press conference following the FOMC’s Dec. 18 meeting.4 Barring “further progress on bringing inflation down” it is “appropriate for [the Fed] to move more cautiously” with additional rate cuts.

The BlackRock Investment Institute, meanwhile, foresees “persistent inflation pressures fueled by rising geopolitical fragmentation, plus big spending on the AI buildout and the low-carbon transition.”5 (Read more in BII’s 2025 Investment Outlook)

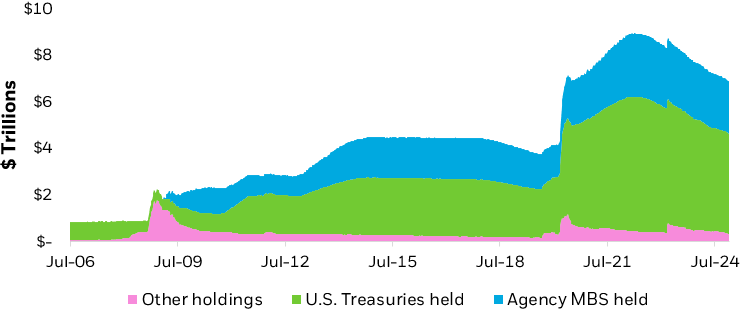

Combined with America’s rising debt and deficits, that macroeconomic backdrop suggests long-term Treasury yields will likely remain ‘higher for longer’ as investors demand higher compensation for risk.

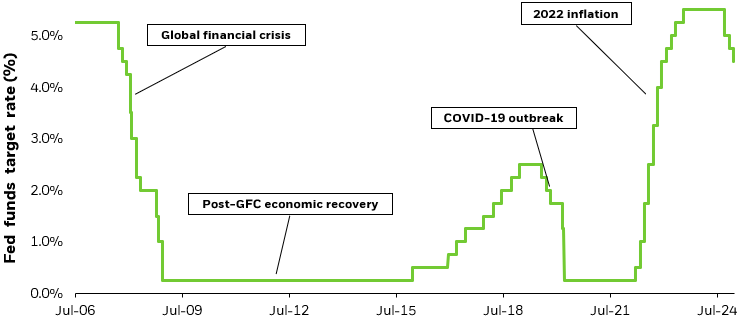

How far and fast the Fed will cut in 2025 — and if they move rates at all — will be dependent on economic data, barring exogenous shocks like the COVID-19 pandemic. Fed Chairman Powell has repeatedly stressed the Fed is “data dependent” in its decision-making, with a stated long-term inflation target of 2%.6

Our outlook for Fed policy is based on expectations for the U.S. economy to slow slightly but remain in expansion — combined with our understanding of the Fed’s dual mandate.