The answer depends on your individual circumstances, goals, where you plan to live and how you plan to spend time in retirement. But whether you’re spending time with family, traveling, or engaged in hobbies and intellectual pursuits, some retirement-planning truths apply to pretty much everyone:

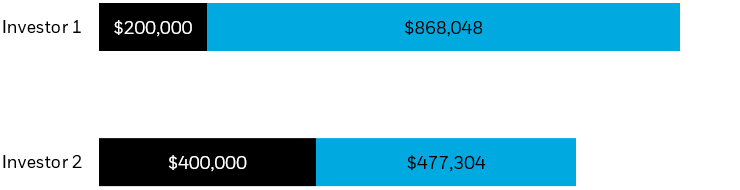

- It’s never too late to get started, but the earlier you start planning and investing, the better chance you’ll have of meeting your retirement goals.

- Your retirement plan needs to get you through retirement, not just to it. This is especially important since retirement can last decades.

- Inflation will reduce your purchasing power over time.

Unfortunately, most Americans don’t feel confident about retirement. Only 56% of people investing for retirement through a workplace plan like a 401(k) feel they’re on track.1 The results are even worse for people without access to a workplace plan.

But don’t despair. The good news is we offer the tools to simplify retirement investing with iShares LifePath Target Date ETFs. These funds are a simple, comprehensive solution, with asset allocations that change to seek the right risk at the right time. And the funds come with the convenience, affordability, and accessibility of an ETF.