- Bitcoin exchange-traded products (ETPs) are facilitating greater exposure for investors who had been interested in crypto but wanted a familiar and efficient wrapper.

- In their first year, spot bitcoin ETPs have drawn unprecedented demand, accumulating over $105 billion in assets under management (AUM) across various issuers.1

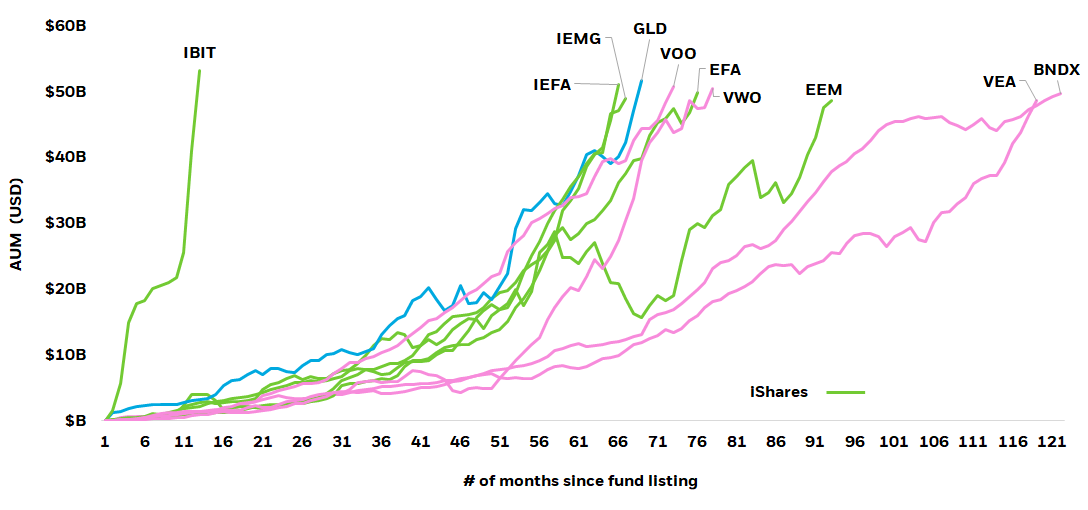

- The iShares Bitcoin Trust ETF (IBIT) became the fastest ETP to reach several milestones, including $50 billion AUM.2

- Bitcoin ETPs have paved the way for more innovation in getting exposure to digital assets, including the launch of Ether ETPs, such as the iShares Ethereum Trust ETF (ETHA) and options on IBIT, giving investors more tools to participate in digital assets.

Getting exposure to digital assets via the bitcoin bridge

Jan 13, 2025 Commodity

Learn how the combination of bitcoin and the exchange-traded product wrapper helps more investors get exposure to digital assets.

KEY TAKEAWAYS

INTRODUCTION: ONE YEAR OF DIGITAL ASSET ETPs

When spot bitcoin exchange-traded products (ETPs) first launched in the U.S. on Jan. 11, 2024, it represented the creation of a proverbial bridge from traditional finance into bitcoin. Prior to the launch of bitcoin ETPs, U.S. investors primarily accessed digital assets through crypto exchanges, which often came with operational, tax and custody complexities.

Based on the unprecedented demand for bitcoin ETPs, it seems a wide variety of investors — from individuals to institutions — had been interested in crypto but wanted a familiar and efficient vehicle in which to get exposure.

Wrapping digital assets like bitcoin — the world’s largest digital asset by market cap3 — in regulated financial instruments such as ETPs helped investors get exposure to these assets through trusted providers like iShares on familiar platforms like Fidelity. (Learn more about how to buy ETPs.)

This bridge to bitcoin has proven to be a two-way street. While traditional investors have moved into digital assets via bitcoin ETPs, some investors previously focused only on digital assets are opening traditional brokerage accounts and using ETPs, possibly for the first time. This is creating an on-ramp for them to diversify portfolios across other asset classes, a cornerstone of long-term investing success.

Timeline

- January 11, 2024

Launch of spot bitcoin ETPs, including iShares Bitcoin Trust ETF (IBIT). - March 1, 2024

IBIT becomes fastest ETP to reach $10 billion AUM. - April 20, 2024

Bitcoin halving cuts rate at which new bitcoin is issued in half to 3.125 per block. - July 23, 2024

Launch of Ether ETPs, including iShares Ethereum Trust ETF (ETHA). - November 19, 2024

IBIT options begin trading, the first for spot bitcoin ETPs. - December 4, 2024

IBIT reaches $50 billion in AUM.

Source: BlackRock, December 31, 2024.

GETTING EXPOSURE TO DIGITAL ASSETS WITH ETPs

Creating more access points and expanding the investible universe are hallmarks of exchange-traded products, which have a long history of innovation. Since the first ETPs debuted in the early 1990s, this financial vehicle has empowered investors of all types to easily and conveniently access broad market exposures, as well as more-targeted investments in previously hard-to-reach markets. For many investors, bitcoin had been one such market prior to the launch of bitcoin ETPs.

Being able to gain bitcoin exposure via the ETP wrapper has proven to be a compelling combination for investors. In their first year, bitcoin ETPs have drawn unprecedented demand, posting $57 billion in net in-flows through December, and over $102 billion in assets under management across various issuers.1 The iShares Bitcoin Trust ETF (IBIT) became the fastest ETP to reach $10 billion in AUM, 50 days after launch, and to reach $50 billion, in December 2024.4

Figure 1: Number of months for ETPs to reach $50 billion in AUM (USD)

IBIT is the fastest ETP ever to reach $50 billion in AUM

Source: BlackRock Global Business Intelligence, as of Dec. 31, 2024. To better understand the similarities and differences between investments, including investment objectives, risks, fees and expenses, it is important to read the products' prospectuses.

Chart description: Line graph showing the AUM accumulation of ETPs across a variety of issuers.

CONCLUSION

Bitcoin ETPs have paved the way for more innovation in accessing digital assets, including the launch of Ether ETPs such as the iShares Ethereum Trust ETF (ETHA) and options on IBIT, giving investors more tools to participate in digital assets.

Despite these early milestones, these are still early days for digital assets. Spot bitcoin ETPs are just one way investors can get exposure to bitcoin. They currently represent a small portion of the overall bitcoin market, just 6% of the total supply of bitcoin outstanding.5

Download the PDF for a deeper look at the first year of bitcoin ETPs: market demand, investor trends and market quality.

The iShares Ethereum Trust ETF and iShares Bitcoin Trust ETF are not investment companies registered under the Investment Company Act of 1940, and therefore are not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. The Trusts are not commodity pools for purposes of the Commodity Exchange Act. Before making an investment decision, you should carefully consider the risk factors and other information included in the prospectuses.