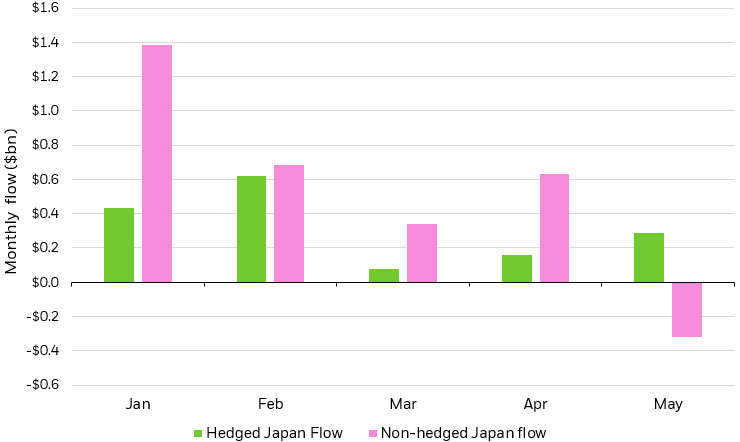

After starting the year with a meaningful rally and strong inflows, Japanese ETFs are in outflow mode. Since the beginning of 2023, Japanese equities have gained as much as 52% on the back of continued investor interest due to the return of economic growth and supportive governance policies, resulting in a steady stream of monthly inflows into Japan ETFs.5

More recently, however, investors have opted to take profit on double-digit gains. For the first time this year, Japanese ETFs have lost assets. Outflows have been led by non-currency hedged funds, which have sharply lagged behind their currency hedged peers this year as the yen reached decades-low levels compared to the USD.6

Un-hedged Japan ETFs lost $315mn in May, marking a turn from the $3bn of inflows added between January and April. Notably, hedged Japanese ETFs remained asset gatherers in May, adding $253mn7 as investors take a more nuanced view on Japan exposure. We remain constructive on Japan over a medium term horizon.