KEY TAKEAWAYS

- When investing for retirement, it’s critical to stay focused on after-tax returns. ETFs are generally tax efficient, which can help investors keep more of what they earn.

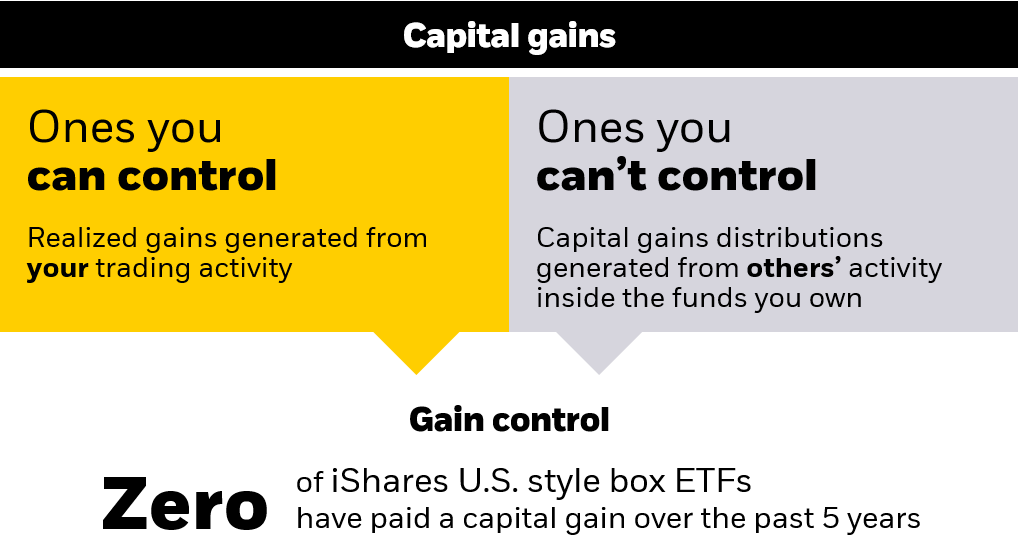

- Low turnover and insulation from the actions of other shareholders are keys to the tax efficiency of ETFs.

- ETFs held 26% of U.S. managed fund assets but accounted for less than 1% of capital gains distributions in 2022.1

You’ve probably learned that keeping fees low can be a big driver of successful investing. And while keeping fees low is important, taxes may actually be more harmful to long-term returns than fund management fees.

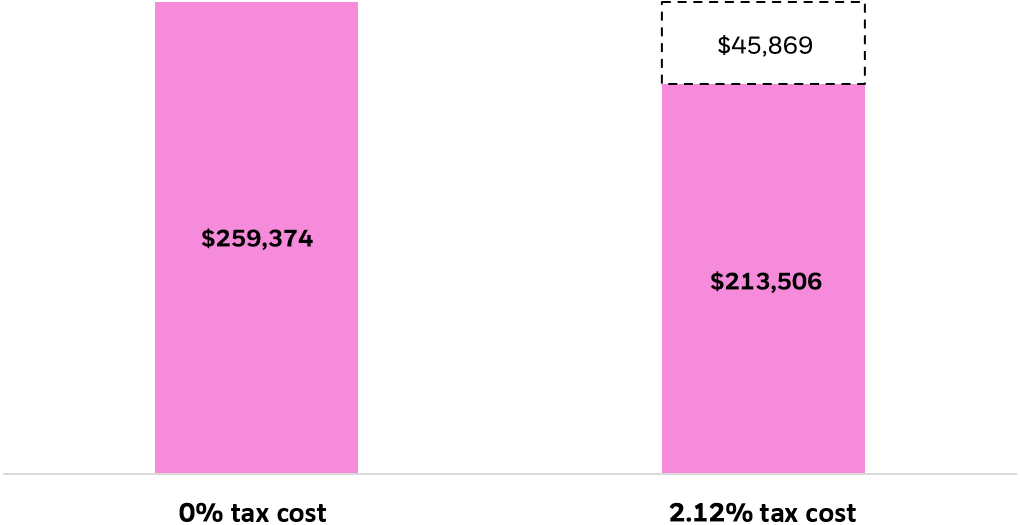

For example, the average annual tax cost for active U.S. large-cap mutual funds was 2.12% for the 10 years ending in 2022, more than double their average annual expense ratio of 0.85%.2 And while 2% may not seem like a big tax burden, a hypothetical $100,000 portfolio would have suffered a tax drag of over $45,000 after a decade of 10% average annual returns.3