00:00 – 00:20

AARON

Pop quiz time. What is an active ETF?

A. ETFs that Lift weights

B. ETF that are newly launched.

C. ETFs that are managed by expert portfolio managers.

D. ETFs that only include equities.

The answer and much more coming up. This is In The Know...

00:24 – 00:40

AARON

I'm Aaron Task and my guest for this episode is Jorge del Valle Head of Active Investments for the Americas at Blackrock. Jorge okay so you heard my pop quiz at the beginning. I know you know the answers, but what is an Active ETF? And more importantly, perhaps why do you think they're growing so much in popularity right now?

00:40 – 1:18

JORGE DEL VALLE

Hi Aaron. First of all thank you. Thank you for having me. I'm delighted to be here. Look, right answer is it's letter C, even though I love the other multiple-choice answers. But but they're not — they're just not right. It's it's definitely letter C.

And look the way I think about Active ETFs it's really the evolution of what we know as ETFs. And for the record, ETF stands for exchange traded funds. Now, historically when we've spoken about ETFs we're speaking about an investment vehicle that tracks an index. So if you're buying an ETF that tracks the S&P 500, the ETF is literally buying the 500 stocks of that index, in this case the S&P 500.

1:18

AARON

In the same weights.

1:19 – 2:32

JORGE

The same weights, in the same in the same weights as the index. Right.

Now an Active ETF is the evolution of that. And really what we're doing is using the ETF as an investment vehicle to bring actively managed strategies in that vehicle. Right? So for example, we recently launched, an Active ETF, it's called BELT.

It stands for Blackrock Equity Long Term we can speak a little bit more about that. But really what that ETF is trying to do is to outperform the S&P 500. And what that means is that Alister Hibbert, who is the portfolio manager at Blackrock for that Active ETF, will not buy the same 500 stocks of the index, but rather will pick his preferred stocks where he has a positive view on those, right, where he thinks he will deliver a return for our clients and will overweight those and will actually underweight or even not hold the ones that he doesn't like.

And with that, he's trying to outperform that particular benchmark.

So all in all is an evolution of ETFs as we know them. They don't necessarily need to be indexed anymore. They could provide a certain outcome, that outcome being an alpha seeking outcome to outperform a benchmark or some other outcomes like for example, income or some others.

2:32 – 3:02

AARON

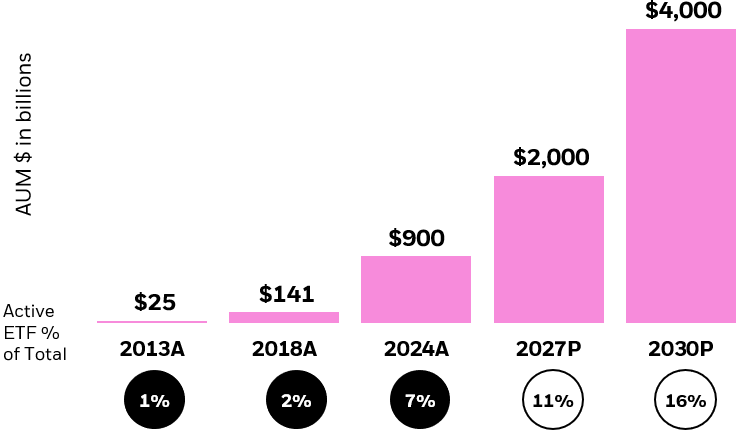

Okay, we'll we'll get to those different outcomes in a minute. But, you’re the coauthor of a new report available on iShares.com and BlackRock.com that is forecasting an over four times increase in active ETFs under management to $4 trillion, with a T trillion by 2030.

Why do you think there's such a big draw for investors into active ETFs now.

And also is this a new tool in the toolkit for investors. Or do you think it's going to replace something that's historically been there.

3:03 - 4:39

JORGE

Yeah. So so look the numbers are pretty massive right? I cannot think of any other industry growing at that pace at that speed. So it's pretty it's pretty impressive. Let me share some other data with you.

Last year, Active ETFs captured 56% of the US ETF industry’s net new revenue. So they're not only growing in size, they're growing also in the revenue they're bringing to, you know, the different companies that are launching these Active ETFs. So what that really means is that investors or clients are also picking active ETFs for their exposures for their portfolios that they're managing right now.

To try to answer your question, why? Why are we seeing that growth? I think there's a few things. The first one is it's access, right? It's access to specialized strategies where before, again, you were buying the S&P 500 and tracking the index. Now you're buying the same vehicle, an active ETF, but you're getting access to specialized portfolio managers that can do something else for you, which really means deliver alpha on top of those benchmarks, right?

So number one is access. Number two is increased liquidity and transparency. So when you think about Active ETFs for the most part they're fully transparent. You know, as an investor what you own and any single point in time compared to, for example structure notes which many times you don't know what it is. And now we have some Active ETFs that can do structured notes as well. Right.

So transparency is another one — liquidity is a third one actually where I need ETFs as well. Know them. You can they're highly liquid. They have different sources of liquidity. And you can, you know, trade in your brokerage account in the stock exchange.

You could literally buy anything in the market.

04:40 - 04:42

AARON

You get a price that's transparent when you put in your order.

04:42 – 5:47

JORGE

That's exactly right. that's related to transparency. So access is number one. Transparency is number two. Liquidity to your point is number three and number fourth, and really, really important is tax efficiency. Right? Right. Given that Active ETFs or ETFs overall tend to be — depending on the jurisdiction of course — more more tax efficient.

So those are some of the reasons why we see Active ETFs as growing. But back to your question around also mutual funds. We totally expect active ETFs to coexist with mutual funds. And I want to be very emphatic on this. Mutual funds in our opinion, are not going anywhere, for several reasons. But the perhaps one important one is that mutual funds will still be the preferred vehicle for some of the investors.

Or even certain platforms where mutual funds are available, such as retirement, or strategies that are capacity constrained and less liquid, that you can actually not launch in an active ETF. So, we get that question a lot. And it's important to be very emphatic around that. We do think that Active ETFs will coexist with what we know as traditional mutual funds.

5:47 – 5:54

AARON

So why now the why do you think there's so much interest from investors in these active strategies?

5:54 - 8:19

JORGE

Yeah, it's a great question. Look, I think three maybe three things that I would highlight. The first one and we spoke about it's it's access. And when I think of some industries outside outside of asset management. think for example, the way you used to take a taxi to go to the airport at five in the morning. And the anxiety of not knowing if the taxi would come or not come. Think how you get that taxi today. Right. And how successful those companies and those industries have been. So think of the same example for the hotel industry where before you, you know, just had a couple a handful of hotels. Now you can go to someone else's house, right?

When I think about the, the success of those industries, really, really what I'm thinking about is they are successful because they were able to eliminate the friction between the product — the hotel, the taxi — and the consumer.

What I'm trying to say is that Active ETFs are going to keep growing, and they have been growing, because they provide access and they eliminate the friction to particular investments that clients before — people like you and I — were not able to access and now they can.

So access is number one.

Number two, it's really markets, right? And we can talk about this for a very long period of time but when I think about markets today, there hasn't been, at least in my career, a better time to be an active investor. The way I would try to explain this is to me, there is a before COVID era and an after COVID era.

And when you think about the before COVID era, and let's try to constrain that a little bit more from 2008, the global financial crisis, to COVID, it was a very benevolent market to invest. And what that means is money was free, rates were zero. There was no volatility in the markets. There was excessive supply. Right.

And really what it meant is, it didn't really matter where you invested. You did pretty well. You did very well. You get a little bit less well, but you did very well in equities, in fixed income, you name it. For the most part, right. After COVID, the situation is completely different. We're living in an inflation era. Rates are at different levels and we can debate if the Fed is going to bring rates down or not this year. But what that has created it's been, it's been volatility. There has been inflation volatility where we've seen prints CPI prints going down and then going up and then going down. Right.

8:19 - 8:22

AARON

And the market freaks out every time depending on which direction.

08:22 - 08:30

JORGE

And that creates volatility. There has been earnings volatility. There's been rates volatility. There's been stock volatility. You name it right.

08:30 - 08:32

AARON

Political I'll just put it out there. Geopolitical.

08:33 - 8:59

JORGE

Yeah geopolitical like without going any further over 50% of the world's population had to vote this year. Right right. Think of India. Think of Mexico this year. Think of the US actually going to elections, later this year. Now, what I tend to tell clients is volatility tends to have a negative connotation. It's a word that, you know, derives uncertainty and volatility...when someone talks about volatility people react like, no that's not for me.

08:59 - 09:03

AARON

It's become a euphemism for the market's going down. Volatility is in both directions.

09:03 - 09:51

JORGE

That's exactly right. But volatility, from an investment standpoint, what it really means is dispersion. And dispersion means opportunities. Because if there's volatility and some stocks are going to do really well and some stocks are not going to do well, if I'm an investor and I have the investment skills and I pick the stocks are going to do well, well, that's a positive outcome for my portfolios, right?

So markets is the second big component of the driver of the growth of of this.

So just to recap access was on the sort of like the elimination of the friction was number one. Markets was number two. And then the third one is really an industry trend, which is, the adoption of fee-based practice in the wealth business, where we see more financial advisors building model portfolios and Active ETFs are a big component of of those toolkits for them to build portfolios.

9:52 - 10:03

AARON

Right. And just to clarify, when you're giving that example, you're talking about picking the right stocks. But active ETFs go across all different asset classes, right? International as well. Fixed income across the board.

10:03 - 10:29

JORGE

Stocks, fixed income, multi-asset, U.S only, global. You name it, it goes across the board.

Yeah.

When we think about, different ETFs that we've launched, for example, BINC Right which is, an income ETF managed by Rick Rieder here at the BlackRock the CIO of of fundamental fixed income at BlackRock we see that multi-sector ETF that it's aiming to deliver income, play a critical role in, portfolios today.

10:29 - 11:00

AARON

And for our friends in compliance, you mentioned BINC. The full name of that fund is the Blackrock Flexible Income ETF. That's Rick Rieder's fund. You know, we've talked a lot about active management. Obviously active ETFs.

So that gets to a question I had again about the report I mentioned earlier. We described three different categories of active ETFs: alpha seeking, outcomes and exposures. I'm pretty sure I know what alpha seeking refers to. You're going to outperform a benchmark or that's the goal at least.

How would you describe the other two outcomes and exposures?

11:00 - 12:00

JORGE

So it's really easy. So outcomes are strategies that replicate defined outcomes, that were previously only available in vehicles such as for example, structured notes. So as I said before, structured notes are highly opaque, they're not very transparent to the end investor.

So think of outcomes as literally Active ETFs are trying to deliver an outcome. I'll give you I'll give you an example. We launched last year an Active ETF it's called BALI — stands for Blackrock Large Cap Income ETF. It's managed by our systematic team here at Blackrock. And really what that ETF does is to seek consistent income with lower volatility than the S&P 500.

So what we do is to buy stocks from the S&P 500. and we write covered calls on top of that. So as an investor the experience you get is you buy the active ETF, you have exposure to good quality stocks in the large cap world in the US, S&P 500. But then you get income on top of that because of the ability we have to write covered calls within that structure.

12:00 - 12:16

AARON

Interesting. So just talk about that for a minute because I feel like everybody's father in law, my father in law, is always talking about ‘I'm going to write covered calls.’ You're telling me I can buy an ETF, that where are professionals going to do it for me? And I don't have to think too hard about what I’m actually doing and how to do it right, quote unquote.

12:17 - 12:36

JORGE

That's that's exactly right. And not only you're buying covered calls, you're buying a strategy that is transparent, that is liquid that you can access in your brokerage account that actually has an underlying high quality, large-cap stocks in the U.S. And on top of that, we're doing covered calls and you're getting income from all of that wrapped in the same active ETF.

12:37 - 12:39

AARON

Okay. So that's that's outcomes. And what about exposures.

12:40 - 13:38

JORGE

So exposures it's really a strategy or an Active ETF that offer investors access to markets that are not easily investable via indexing. Right. So think of, for example, what we call frontier markets. So the way you think about it is developed markets, emerging markets, and frontier markets. Frontier markets tend to be less liquid. They have less availability from an index standpoint. So for those markets, if you want access, maybe you know, an Active ETF makes sense because there's not an index to track. Right. So that would be an example there.

The other one is you know, some strategies and I'll give you another example. We, we launched what we called C-L-O-A like CLOA, which is an Active ETF we categorize it or classified as exposure. And it's an ETF that seeks to provide capital preservation, and income by investing principally in a portfolio of U.S. dollar denominated triple-A rated CLOs. CLO stands for collateralized loan obligation. So again, an example of access because.

13:39 – 13:40

AARON

Again, not something I'd probably want to do myself.

13:41 – 13:43

JORGE

Exactly. Or even you, you can do yourself for that matter, right.

13:44 – 13:48

AARON

Yeah. If I wanted to, what I wouldn't be able to. Now, I can do it with the convenience of the ETF.

13:49 - 13:52

JORGE

On your brokerage account. And again, highly liquid transparent, provides you the access.

13:53 - 13:58

AARON

Alright. My guest has been Jorge De Valle, head of active investments for the Americas at BlackRock. Jorge, thanks very much.

13:58 - 13:59

JORGE

Thank you for having me.

14:03 - 14:13

Disclosures:

Visit iShares.com to view a prospectus which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing. Investing involves risks, including possible loss of principal.

Carefully consider the Funds' investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds' prospectuses or, if available, the summary prospectuses which may be obtained by visiting www.iShares.com or www.blackrock.com. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Actively managed funds do not seek to replicate the performance of a specified index, may have higher portfolio turnover, and may charge higher fees than index funds due to increased trading and research expenses. Active funds are subject to management risk, which means the fund manager's techniques may not produce desired results, and the selected securities may not align with the fund's investment objective. Legislative, regulatory, or tax developments may also affect the fund manager's ability to achieve the investment objective.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in the value of debt securities. Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

While the BlackRock AAA CLO ETF (the “Fund”) will invest primarily in CLO tranches that are rated AAA, such ratings do not constitute a guarantee of credit quality and may be downgraded. In stressed market conditions, it is possible that even senior CLO debt tranches could experience losses due to actual or perceived defaults, and rating downgrades and forced liquidations of underlying collateral. CLO securities may be less liquid than other types of securities and there is no guarantee that an active secondary market will exist or be maintained. The CLO securities in which the Fund invests are managed by investment advisers independent of BlackRock Fund Advisors, the Fund’s investment manager, and an affiliate of BlackRock Investments, LLC. Any adverse developments with respect to the CLO manager may adversely impact the CLO securities held within the Fund.

A BuyWrite Strategy ETF’s use of options may reduce returns or increase volatility. During periods of very low or negative interest rates, the Underlying Fund may be unable to maintain positive returns. Very low or negative interest rates may magnify interest rate risk. In a falling interest rate environment, the ETF may underperform the Underlying Fund. By writing covered call options in return for the receipt of premiums, the ETF will give up the opportunity to benefit from increases in the value of the Underlying Fund but will continue to bear the risk of declines in the value of the Underlying Fund. The premiums received from the options may not be sufficient to offset any losses sustained from the volatility of the Underlying Fund over time. The ETF will be subject to capital gain taxes, ordinary income tax and other tax considerations due to its writing covered call options strategy.

Funds that concentrate investments in specific industries, sectors, markets or asset classes may underperform or be more volatile than other industries, sectors, markets or asset classes and the general securities market.

Transactions in shares of ETFs may result in brokerage commissions and may generate tax consequences. All regulated investment companies are obliged to distribute portfolio gains to shareholders. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.