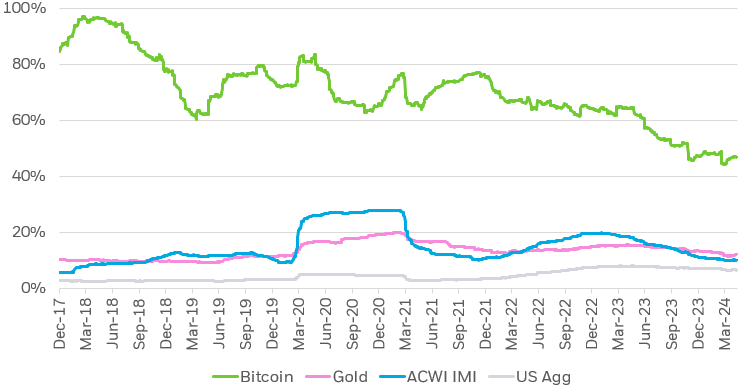

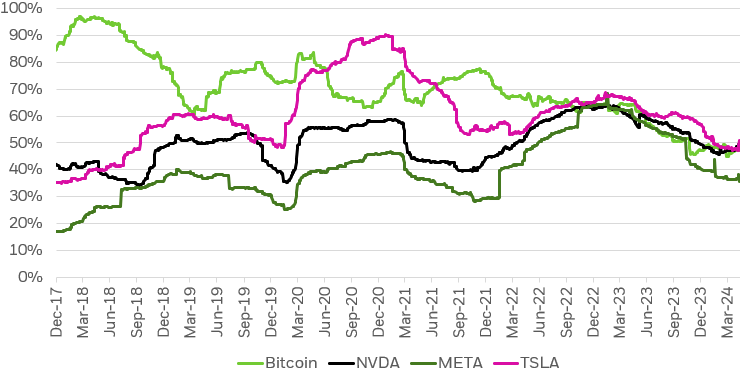

Arguably more important than bitcoin’s standalone volatility is the impact it will have on a portfolio’s overall volatility. Because bitcoin has been relatively uncorrelated to traditional assets like stocks and bonds over long time horizons, the way that it has behaved in a portfolio is unique. In fact, a bitcoin allocation may actually have a smaller impact on portfolio volatility than similar-sized positions in certain individual stocks. With large allocations, bitcoin’s standalone volatility can have an outsized impact on portfolio risk. But at more modest sizes, bitcoin’s typically low correlation has tended to provide modest diversifying effects while tapping into a novel source of return.

Still, investors must be aware of bitcoin’s immense volatility and should be prepared to weather long and potentially painful drawdowns. That’s why we believe anyone considering investing in bitcoin should understand their time horizon, risk tolerance, and have clear investment objectives. Investors can also navigate near-term volatility by using common portfolio management methods such as dollar cost averaging, regular rebalancing, and maintaining a long-term investment horizon.