Updated: November 10, 2025

3 ways bond buy-write ETFs can benefit investors

Jul 25, 2023 Income

KEY TAKEAWAYS

- A buy-write investment strategy — also known as a “covered call” — consists of owning a security and simultaneously selling a call option on that security.

- The goal of a buy-write strategy is to generate current income from the sale of option contracts. In return, the investor’s upside potential from the security is limited.

- In 2022, iShares launched the first ever ETFs to employ a bond ETF buy-write strategy, making it simple for all investors to add covered call strategies to their portfolios.

iSHARES 20+ YEAR TREASURY BOND BUYWRITE STRATEGY ETF

TLTW may provide enhanced income compared to traditional U.S. Treasury bonds by selling monthly covered call options.

iSHARES INVESTMENT GRADE CORPORATE BOND BUYWRITE STRATEGY ETF

LQDW may provide enhanced income compared to traditional U.S. investment grade bonds by selling monthly covered call options.

iSHARES HIGH YIELD CORPORATE BOND BUYWRITE STRATEGY ETF

HYGW may provide enhanced income compared to traditional U.S. high yield corporate bonds by selling monthly covered call options.

SEEK INCOME AND DIVERSIFICATION WITH BUY-WRITE BOND ETFs

Buy-write strategies — also known as covered call writing — have been used since stock options were first listed in the 1970s.1 Professional and other sophisticated investors have historically used options as tools to seek to hedge risks and generate income in stock portfolios. In 2022, iShares opened a new frontier of options-based investing by launching the first covered call ETFs to use bond ETFs as the underlying securities.2 These three Bond BuyWrite Strategy ETFs make it possible for all investors to easily employ a buy-write strategy and potentially generate income in bond portfolios.

This innovation was made possible by the growth of bond ETFs, which now have over $3 trillion3 in assets under management, and their associated options markets. iShares Bond BuyWrite Strategy ETFs offer investors three main potential benefits:

- Attractive cash flows: Each iShares Bond BuyWrite Strategy ETF holds shares of its respective underlying ETF and writes monthly call options in an effort to add income. Each month, the ETFs are designed to pay distributions with two components: dividends from the underlying ETF plus any proceeds from the options sales.

- Downside protection: In a down market, the income earned from the sale of call options may help offset some losses in the underlying security. More on this later.

- Diversification: Traditional bond returns are primarily driven by changes in interest rates and credit spreads. For a buy-write strategy, income earned from the sale of option contracts is typically driven by other risk factors, such as volatility.

Option premiums may add extra income

12-month trailing distribution rates of iShares Bond BuyWrite Strategy ETFs compared to their corresponding underlying ETFs.

Source: BlackRock, as of 10/31/2025. Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For most recent month-end performance, each funds’ 30-Day SEC yield and prospectuses, click on the following links: TLT | TLTW | LQD | LQDW | HYG | HYGW.

Chart description: Bar chart showing the latest 12-month trailing distribution rates of iShares Bond BuyWrite Strategy ETFs compared to their corresponding underlying ETFs.

As with any investment, it’s important to understand the risks and potential outcomes associated with an options-based approach. But, first, let’s examine what a buy-write strategy is and how it works.

WHAT IS A BUY-WRITE STRATEGY?

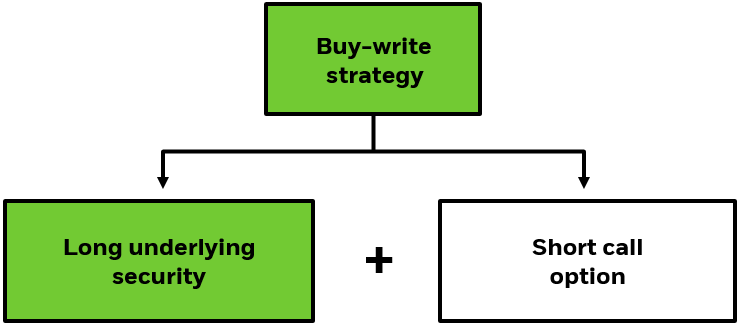

A buy-write strategy includes two components:

- Buying a security – such as a stock or ETF or index exposure known as the “underlying”, and simultaneously.

- Selling (or “writing”) a call option on the underlying.

A call option is a financial contract that gives the buyer the right to purchase the underlying security from the seller at a pre-determined price, called the “strike price”, and within a specific timeframe. The seller receives an up-front payment, known as the “option premium”, but has the obligation to deliver the security if the option is exercised.

Components of a buy-write strategy

Source: BlackRock. For illustrative purposes only.

Chart description: Flow chart showing the two components of a buy-write strategy: a long position in the underlying security, and a short call option.

By holding the underlying security and writing the call, the buy-write strategy can experience three potential outcomes:

- When the price of the underlying declines, the option is said to be “out of the money” and would expire worthless. The buy-write investor keeps the option premium, which could help to offset some of the losses in the underlying security.

- When the price of the underlying is unchanged, returns would largely be driven by the income earned from the option premium. The amount of income would depend on several factors, including the volatility of the underlying security.

- When the price of the underlying rises above the strike price, the option would be “in the money”, and the buyer could exercise the option for a profit. This represents a loss for the seller, but the buy-write strategy is considered “covered” because gains in the underlying security could help offset these losses. In this scenario, the total profit for the buy-write is limited to the difference between the strike price and the original price of the underlying, plus the option premium.

Return scenarios of a buy-write strategy vs. the underlying

| Underlying security | Buy-write strategy | Buy-write strategy vs. underlying: | Rationale |

|---|---|---|---|

| Appreciates | Potentially appreciates | Potentially underperforms | Covered call sets a ceiling on the upside |

| Unchanged | Potentially appreciates | Potentially outperforms | Premium income improves performance |

| Depreciates | Potentially depreciates | Potentially outperforms | Premium income offsets losses |

Source: BlackRock. For illustrative purposes only. The hypothetical illustration above of various investment outcomes are hypothetical in nature, do not reflect actual investment results and are not guarantees of future results. This information does not represent the actual performance of any iShares or BlackRock fund or strategy. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

CONCLUSION

Buy-write investing is a well-established investment approach going back to the 1970s. While most buy-write ETFs are focused on stocks, the new iShares Bond BuyWrite Strategy ETFs are the first to implement this approach within fixed income ETFs. Investors can use these ETFs to add a differentiated source of income to their bond accounts.