SEPTEMBER FLOWS

September saw a string of volatility inducing events across the globe: surprise stimulus out of China, military escalations in the Middle East, and powerful market reactions. Here are the top ETF flow trends of the month:

Oct 08, 2024 Global

September saw a string of volatility inducing events across the globe: surprise stimulus out of China, military escalations in the Middle East, and powerful market reactions. Here are the top ETF flow trends of the month:

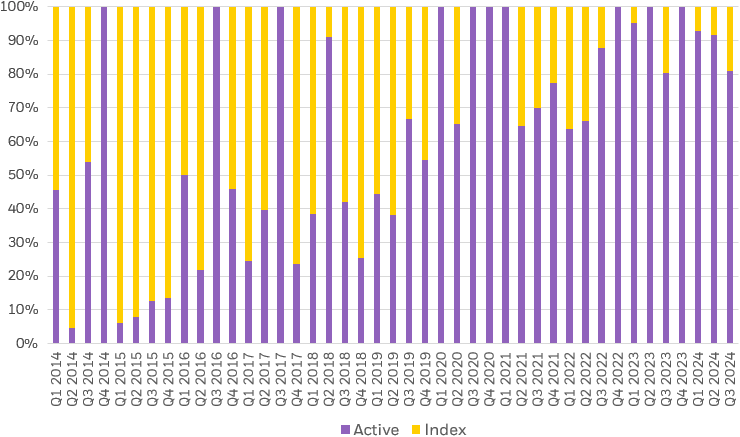

Active ETF launches continue to tick higher. September delivered the arrival of 28 new active funds, accounting for a whopping 72% of all newly minted ETFs.1 Active appetite has been widespread, but flow trends show that investors have notably leaned into active management in underperforming segments:

Source: BlackRock, Markit. ETF groupings determined by Markit. As of October 2, 2024.

Chart description: Stacked bar chart depicting percentage of total ETF launches from 2014 to 2024, broken by active and index.

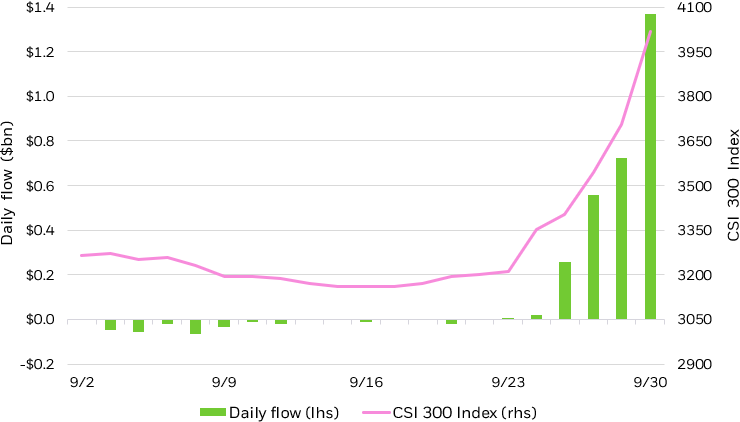

China’s central bank and the Politburo have delivered the most comprehensive stimulus package since the pandemic. Easing of key policy rates and property sector and consumption support are intended to buoy economic growth after a slew of sluggish prints across real estate, industrial production, and consumer confidence.

The market response was rapid and dramatic — the Shanghai Composite Index swelled 21.4% in the five trading days following the announcements while the Shenzhen Component Index gained over 30%, all paired with trading volumes large enough to trigger system glitches.7

The powerful rally was met with powerful flows. China ETFs were on track for a negative September but reversed to add $800mn in three days — by month end, it was the most positive month of flows in over two years. Investors added $1.4bn on the last day of the month alone — a daily flow larger than every other month this year save one.8

Notably, flows into China ETFs did not translate to flows out of EM ex-China strategies. Monthly flows remain robust, signaling that investors continue to opt for granular solutions and trade China separate from broad EM allocations. The pattern holds regardless of positive or negative price action in China — EMXC, iShares MSCI Emerging Markets ex China ETF, hasn’t seen an outflow in almost two years.

Source: Bloomberg, Markit. As of October 1, 2024. ETP groupings determined by Markit. China performance measured by the CSI 300 Index. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Line chart showing CSI 300 Index price performance for the month of September, coupled with a bar chart showing daily flow into China-focused ETFs.

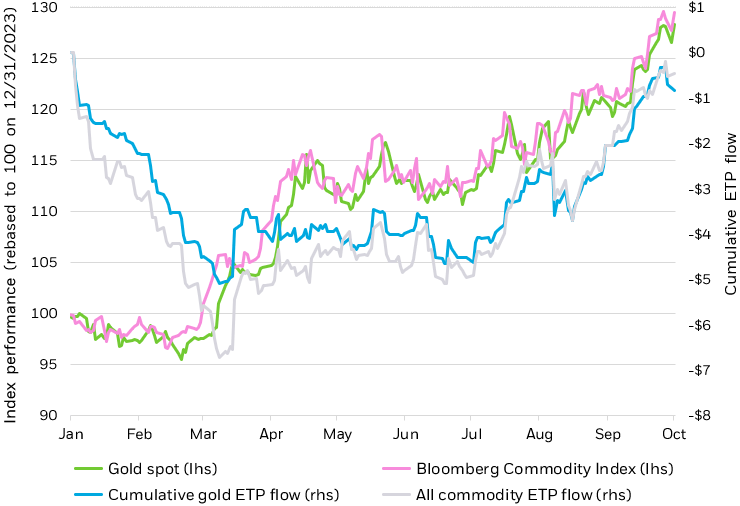

Gold prices steadily climbed on the year, reaching fresh highs even amid a backdrop of weaker interest rate expectations and a strong USD — breaking historical correlations as both factors tend to spell headwinds for gold. Gold now trades above the critical $2,500/oz band, boosted by the beginning of the Fed’s rate cutting cycle and geopolitical volatility in the Middle East. From 2022 to the first half of 2024, central bank demand was the primary driver of gold prices — central banks purchased net 1,037 tonnes and 483 tonnes in 2023 and 1H2024 respectively, sustaining gold prices despite high global interest rates.9 Fed cuts spurred September’s demand, with gold prices rallying over 5% as the start of rate cuts upped the non-yielding asset’s relative attractiveness.10 Gold ETPs gathered $1.47bn in the week of the September FOMC meeting.11

Flows and performance in gold are also tethered to elevated geopolitical volatility overseas. Investors reached for gold, and commodities broadly, in search of a hedge against escalation. All commodity ETPs (which include gold, silver, and copper) added $1.47bn in September, with over 30% of those flows occurring after fighting in the Middle East intensified during the last five trading days of the month.12

Source: BlackRock, Bloomberg, as of October 01, 2024. Chart by GPS Investment Strategy. Gold performance represented by the Gold United States Dollar Spot Index. ETP groupings determined by Markit, ETPs are U.S-domiciled. Index performance is for illustrative purposes only. Index performance does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Line chart showing gold and commodity flows throughout January to September. The chart depicts gold spot, cumulative gold ETP flows, Bloomberg Commodity Index, and all commodity ETP flows.

You can use BlackRock’s Fund Finder tool to explore the entire universe of U.S. listed ETFs. The tool provides advanced ETF screening and monitoring capabilities to help investors identify which funds may help achieve their goals. Soon you will also be able to view ETF flows data in the tool.