00:00 – 00:19

Faye Witherall

Commodities, particularly gold and oil, are frequently viewed as a hedge against geopolitical tension. So why have they diverged so sharply in 2024, a year of heightened geopolitical uncertainty?

And more broadly, what larger role can commodities play in a portfolio?

So stick around to find out. This is In The Know.

00:24 – 00:36

Faye

Hi, I'm Faye Weatherall. I'm an associate on the iShares Investment Strategy Team.

And my guest for this episode is Kristy Akullian. She's the Head of iShares Investment Strategy for the Americas and she is also my boss.

So Kristy welcome.

00:37 – 00:38

Kristy Akullian

Hi Faye. Thanks for having me.

00:39 – 0:56

Faye

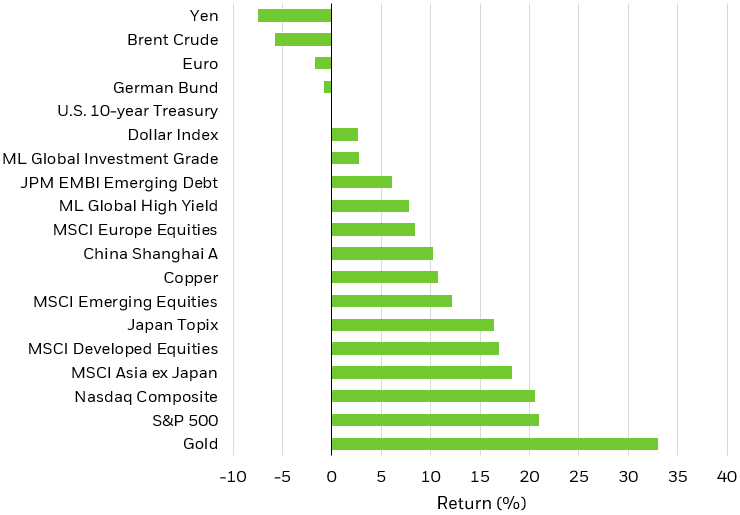

So Kristy, gold is the best performing major asset so far this year. Recently hitting record highs near $2,700 an ounce.1 Now when we compare that to oil, it still remains well below its April peak. So how do you explain that divergence, especially given all the turmoil in the Middle East?

00:57 – 2:24

Kristy

Great place to start. So, you know, I think that the returns and the prices that we've seen in oil goes against a lot of the conventional thinking. But let's maybe start with gold, which also, I think, by the way, goes against some of the conventional thinking that it's an inflation hedge. So even just think about kind of the post-pandemic period.

So gold was really trading sideways in much of 2021 when inflation was surging. And then conversely, gold has risen sharply in 2024 even though we've seen inflation data, such as CPI data, come down really significantly.

In reality, gold tends to trade in a closer relationship to real interest rates and the U.S. dollar, not necessarily inflation.2 What we've seen from the dollar so far this year is that has fallen steadily from sort of mid-June through late September, as investors started to anticipate that the Fed was going to start easing rates and that interest rates were going to fall.

And speaking of the Fed and other central banks, I'd also point out that they've been a really important buyer of gold in sort of an effort to diversify reserve holdings. They've added over 2000 tons of the holdings in just the past two years, which is a really strong demand component for the price return that we've seen on gold.

And gold, lastly, I think is also benefiting from concerns over the U.S. budget deficit as well as the geopolitical uncertainty that you mentioned.

2:24 – 2:26

Faye

Which brings us back to oil.

02:27 – 02:48

Kristy

Right. So actually for this one, I'm going to turn to turn the tables a little bit here. And I'm going to turn the question back to you. Faye, you are sort of the energy czar on our team: What's your take and why has oil struggled this year, giving some of the kind of alarming headlines that we've seen particularly come out of the Gulf, and not to mention the ongoing conflict that we've seen in Russia and Ukraine.

2:48 – 3:36

Faye

Oil has definitely seen some short-term spikes on news from the Gulf. But fundamentally we've seen a challenging year for crude prices. So think that earlier in October, OPEC reduced its forecast for the third straight month for oil demand in 2024 and in 2025. So you pair that with suppressed economic data out of China and a stable supply, and we've seen prices move more sideways, more rangebound.

So we think that trend will continue. And this is absent any attacks on energy production or supply routes in the Middle East, or a prolonged rebound in China's economic activity following recent stimulus.

So, Kristy I'm going to pass this back to you. If that's our base case for oil prices, we think, you know it'll move sideways from here.

What does that mean for the energy sector broadly?

3:37 – 4:37

Kristy

Right. Energy stocks are of course sensitive to the price of oil, as you said. And our base case there is for crude to remain rangebound. But I will say that the sector's performance is fueled by kind of more than just the movement of oil prices.

One factor that we're thinking about right now is we're sort of in the midst of the Q3 earnings season, is that the energy sector is expected to see the largest earnings deceleration among major sectors right now.

And additionally, you know, when we look at the energy sector relative to history, typically energy scores pretty high on our team's quality metrics. But actually where the sector is trading right now is a bit behind it's kind of historical average. So it's relative quality score has actually declined since the start of the year. So all of that put together - I'd say we see potential headwinds ahead and I think we maintain a neutral tactical outlook on energy stocks at the moment.

4:38 – 4:51

Faye

That all makes a lot of sense. Thank you. Christy. I think now we should pivot a little bit and talk about gold. So, you know, how should investors be thinking about gold. Is it too late for them to add exposure? You know will they kind of be adding at the top.

4:51 – 5:48

Kristy

So somewhat surprisingly, given the really strong performance we've seen from gold year to date, we haven't actually seen a corresponding amount of inflows...they just really haven't been there. But I think that is starting to shift. So after spending most of 2024 in kind of outflow mode we saw that the flows for the category have actually started to turn positive, just thanks to the strong inflows that we've seen in Q3.

And with kind of government spending unlikely to slow, you know, regardless of the outcome of the election and the U.S. debt is sort of already breaching some new highs every month, I think there's more reason to believe that gold may have further a price appreciation ahead.

So kind of given the combination of that central bank demand and then the trajectory of U.S deficits and kind of that potential for geopolitical tensions to remain elevated into 2025, investors might consider an allocation to the iShares Gold Trust, or the ticker IAU.

5:49 – 6:03

Faye

You know, it's hard to size gold's weight in a portfolio, especially since everybody's risk tolerance is so unique. But, you know, just generally speaking, what role can commodities play in a diversified portfolio, Kristy?

6:04 – 7:25

Kristy

Yeah. So here the really important consideration is a diversified portfolio. I think that concept is really central to how we think about gold. So historically, commodities — just as a broad asset class — have exhibited low and sometimes even negative correlation to U.S. bonds and stocks and real estate.3 So meaning it moves in opposite directions. And so given that, you know, I think that small allocations to commodities can potentially help diversify and reduce risk overall within a portfolio for a lot of investors who typically just think about the traditional asset classes.

Now, you know, of course not all commodities are created equal and I think some conventional thinking doesn't always hold, as we discussed. But investing in commodities can provide diversification benefits within a portfolio. And they may also serve as a hedge against inflation or geopolitics and sometimes both.

iShares offers a wide range of commodity ETFs across the three categories so broad commodity, physical precious metals and commodity producer ETFs. We could and maybe we should have an entire conversation about investing in commodities and other hedging tools, but I'll say this for now: If you're working with an advisor, I suggest talking to your F.A. about the role commodities can play in a well-diversified portfolio.

7:26 – 7:32

Faye

Okay. Thank you Kristy. I think we covered a lot of ground here and

got a couple of nuggets of good information.

7:33 – 7:36

Kristy

My pleasure. Thanks so much for hosting today, Faye.

7:40 – 7:50

Spoken disclosure:

Visit ishares.com to view a prospectus which includes investment objectives, risks, fees, expenses and other information that you should read and consider carefully before investing. Investing involves risks including possible loss of principal.

Footnotes:

1 Source: Bloomberg, as of 10/15/2024.

2 Source: Bloomberg, BlackRock. Correlations as represented by 120-day rolling correlations over a 10-year period, data as represented by daily closing price from Bloomberg. Correlation measures how two securities move in relation to each other. Correlation ranges between plus 1 and minus 1. A correlation of plus 1 indicates returns move in tandem, minus 1 indicates returns move in opposite directions, and 0 indicates no correlation. As of October 1, 2024.

3 Source: Morningstar Direct, as of 10/1/2024.

Written disclosure:

This information must be preceded or accompanied by a current prospectus for IAU. Investors should read and consider it carefully before investing.

The iShares Trusts are not investment companies registered under the Investment Company Act of 1940, and therefore are not subject to the same regulatory requirements as mutual funds or ETFs registered under the Investment Company Act of 1940. Investments in these products are speculative and involve a high degree of risk.

Commodities' prices may be highly volatile. Prices may be affected by various economic, financial, social and political factors, which may be unpredictable and may have a significant impact on the prices of precious metals.

Following an investment in shares of the iShares Gold Trust, several factors may have the effect of causing a decline in the prices of gold and a corresponding decline in the price of the shares. Among them: (i) Large sales by the official sector. A significant portion of the aggregate world gold holdings is owned by governments, central banks and related institutions. If one or more of these institutions decides to sell in amounts large enough to cause a decline in world gold prices, the price of the shares will be adversely affected. (ii) A significant increase in gold hedging activity by gold producers. Should there be an increase in the level of hedge activity of gold producing companies, it could cause a decline in world gold prices, adversely affecting the price of the shares. (iii) A significant change in the attitude of speculators and investors towards gold. Should the speculative community take a negative view towards gold, it could cause a decline in world gold prices, negatively impacting the price of the shares.

Diversification and asset allocation may not protect against market risk or loss of principal. The strategies discussed are strictly for illustrative and educational purposes and are not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. There is no guarantee that any strategies discussed will be effective. The information presented does not take into consideration commissions, tax implications, or other transactions costs, which may significantly affect the economic consequences of a given strategy or investment decision.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather, an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision.

Shares of the Trust are not deposits or other obligations of or guaranteed by BlackRock, Inc., and its affiliates, and are not insured by the Federal Deposit Insurance Corporation or any other governmental agency. The sponsor of the trust is iShares Delaware Trust Sponsor LLC (the 'Sponsor'). BlackRock Investments, LLC ('BRIL'), assists in the promotion of the Trust. The Sponsor and BRIL are affiliates of BlackRock, Inc.

© 2024 BlackRock, Inc. or its affiliates. All Rights Reserved. BLACKROCK and iSHARES are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.