Our outlook has become modestly more positive since the end of Q1, thanks to the strength of the U.S. labor market, robust capital expenditures, and the resilience of the U.S. consumer, The macro backdrop supports a potential pivot toward riskier, high yielding assets but inflation remains sticky and geopolitical risks have been higher than normal.

Against this backdrop, we believe investors are best served by staying nimble across fixed income, equities, and international markets.

Hi, I’m Kristy Akullian, Head of iShares Investment Strategy for the Americas at BlackRock. Here are some of the key takeaways from our 2024 Midyear Investment Directions.

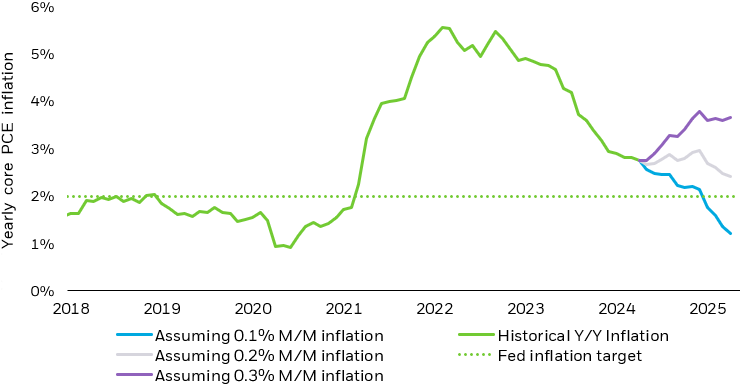

The overall trend towards lower inflation seems clear, but the Federal Reserve has said it needs more data before it would be confident enough to begin cutting rates. We believe continued improvements in inflation and gently slowing growth will allow the Fed to cut rates twice this year, with the first cut potentially arriving as soon as September.

Our expected path of monetary policy and U.S. growth could have important implications for asset allocation.

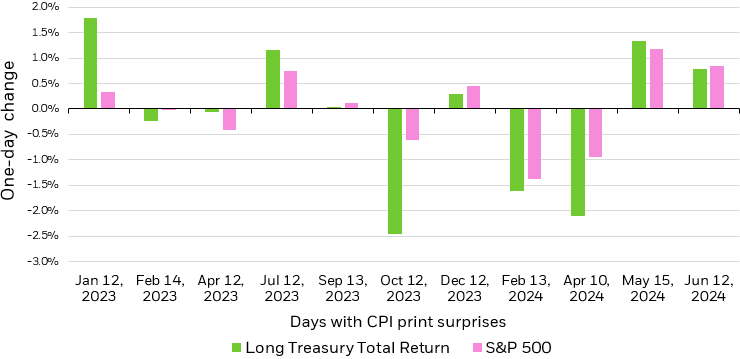

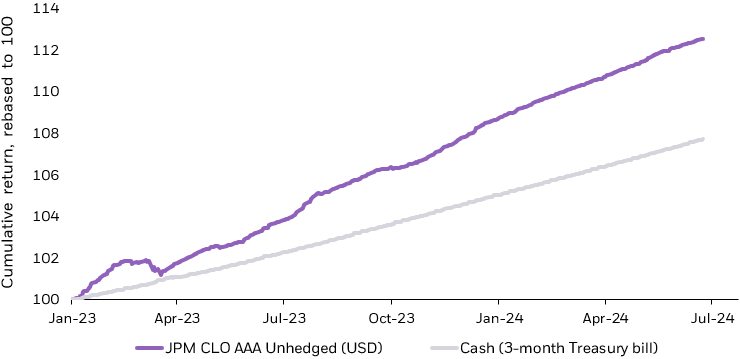

In fixed income, our outlook for normalizing interest rates implies a potentially favorable environment to extend duration out of cash ...and into the 3-to-7 year portion of the yield curve. We also see opportunities in potentially higher-yielding, short duration assets such as collateralized loan obligations or CLOs. Finally, we see a more important role for active management to be more selective within the high yield and corporate bond spaces.

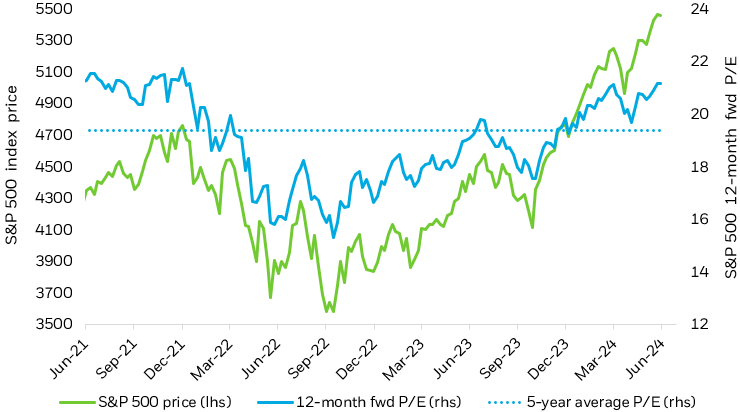

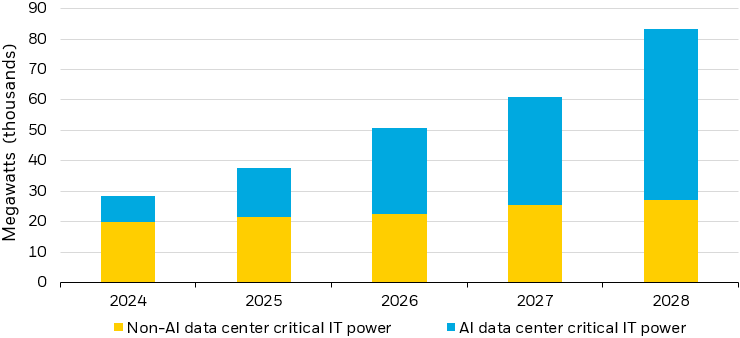

In U.S. equities, we lean into high quality exposures to seek to avoid companies that might come under stress in the Fed’s “higher-for-longer” rate environment. AI has also rapidly altered the investment landscape, leading to, in some instances, triple digit returns in associated companies. We see more potential AI-driven opportunities outside of technology, like the utilities sector. But identifying the most promising opportunities requires vigilance, also underscoring the potential significance of actively managed strategies in portfolios.

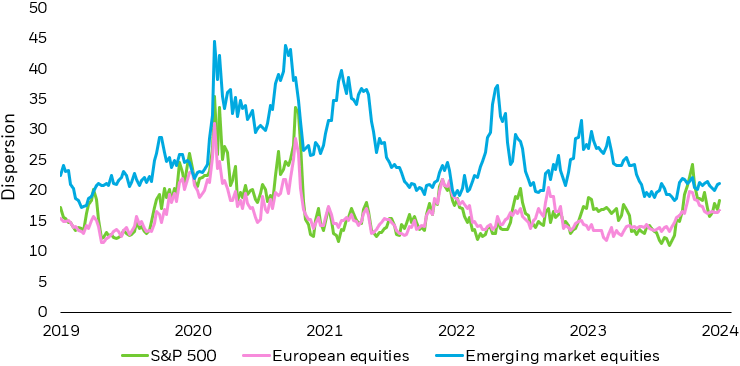

Looking overseas, dispersion between international markets remains higher than pre-covid levels. This shift underscores the need to be selective in international allocations, both on a short-term and long-term basis. It’s a big year of elections around the world, potentially introducing more volatility. We think Investors should look beyond short-term volatility and focus on longer-term strategic trends such as demographic transformations and supply chain rewiring.

These are just a few of the ways we are approaching the rest of the year. Check our full Midyear 2024 Investment Directions and stay tuned for a deep dive into each asset class coming soon.

Until then, I’m Kristy Akullian, thanks for watching!

Disclosures:

Past performance does not guarantee future results.

This material is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date indicated and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and nonproprietary sources deemed by BlackRock to be reliable, are not necessarily all-inclusive and are not guaranteed as to accuracy. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by BlackRock. its officers. employees or agents. This material may contain "forward-looking” information that is not purely historical in nature. Such information may include, among other things, projections and forecasts. There is no guarantee that any of these views will come to pass. Reliance upon information in this material is at the sole discretion of the viewer.

This material contains general information only and does not take into account an individual's financial circumstances. This information should not be relied upon as a primary basis for an investment decision. Rather. an assessment should be made as to whether the information is appropriate in individual circumstances and consideration should be given to talking to a financial professional before making an investment decision. This material does not constitute any specific legal, tax or accounting advice. Please consult with qualified professionals for this type of advice.

Prepared by BlackRock Investments, LLC, member FINRA

©2024 BlackRock, Inc or its affiliates. All rights reserved. iSHARES and BLACKROCK are trademarks of BlackRock, Inc. or its affiliates. All other marks are the property of their respective owners.

iCRMH0724U/S-368498