Updated: December 10, 2025

Put cash to work with short-term bond ETFs

Mar 20, 2024 Fixed Income

Key takeaways

- Investors interested in putting idle cash to work may consider short-term bond ETFs.

- High yields on cash alternatives, such as money market funds, should continue to decline as the US Federal Reserve reduces interest rates.

- Short duration bond ETFs can potentially add more income in an environment of declining short-term interest rates.

Looking to get more out of your cash? Consider short-term bonds, which are currently offering some of the highest yields in the past 15 years.1 Investors may be able to invest in short-term bonds with ETFs to potentially earn more income with cash they don’t need in the near future.

Americans are sitting on over $18 trillion in bank deposits with an additional $7 trillion in money market funds.2 An investment in fixed income funds is not equivalent to and involves risks not associated with an investment in cash or cash alternatives. That said, historically, bonds have tended to outperform cash when interest rates are decreasing.

Short-term bond ETF yields vs. cash and cash alternatives

Source: BlackRock, FDIC, iMoneyNet, as of 10/31/2025. Govt Money Market Funds yield is the average 1-day simple net yield for government-only money market funds. Bond ETF yields are average yield to maturity. It’s important to note that there are material differences between Savings accounts, Money Market Funds, CDs and ETFs, including investment objectives, risks, fees, and expenses. CDs are fixed income investments that generally pay a set rate of interest over a fixed time period until maturity, whereupon the principal is typically returned plus any interest earned. Early withdrawal from CDs may result in interest penalties. Most savings accounts pay compound interest, meaning earnings are added to the balance to create a larger base on which future interest is paid. Most savings accounts allow you to add or withdraw money at any time without incurring a fee. Both Savings accounts and CDs principal investments are insured by the FDIC up to applicable FDIC limits, while ETFs are not FDIC insured and may lose value. Money Market funds typically seek to maintain a net asset value of $1.00 per share, but there is no guarantee they will do so and are not FDIC insured. Most ETFs seek to track an index, before fees and expenses. ETFs trade on exchanges intraday and may incur brokerage commissions. ETF shares can be sold at market price, which may be higher or lower than NAV, and are not individually redeemable from the fund. Diversification may not protect against market risk. Transactions in shares of ETFs may result in brokerage commissions and tax consequences. There can be no assurance that an active trading market for shares of an ETF will develop or be maintained. Short term bond ETFs may experience greater volatility than cash equivalents.

Performance data represents past performance and does not guarantee future results. Investment return and principal value will fluctuate with market conditions and may be lower or higher when you sell your shares. Current performance may differ from the performance shown. For standardized performance and most recent month end performance, click on the fund’s ticker symbol: SGOV | ICSH | FLOT.

Chart description: Bar chart showing that yields on short-term bond ETFs are currently higher than those of conventional savings vehicles.

Consider putting idle cash in bond ETFs

Today’s market may provide opportunities to step out of cash. In October, the Fed announced its second interest rate cut of 2025, reducing the Fed Funds Rate to 3.75%-4.00%. The market expects cuts to continue, with the policy rate seen moving towards 3.00% throughout 2026.3

Rate cuts may reduce the interest paid by cash alternatives. During the 2001 – 2002 rate cut cycle, money market fund 12-month returns fell from 5.8% in March 2001 to 2.6% by March 2002 and down to 1.8% by July 2002.4 Bonds can potentially provide both income and capital appreciation and may outperform cash if short-term yields decline.

Money market yields can fall rapidly when the Fed pivots to rate cuts

In past cycles, money market rates fell by over 2% in the first year following a peak in rates.

Source: Morningstar. Money market fund returns represented by Morningstar's Taxable Money Market category. U.S. bonds represented by Bloomberg U.S. Aggregate Bond Index. Reference to “cash” in chart reflects money market fund returns. Average annualized return is the average annual rate of return over a given period. Past performance does not guarantee or indicate future results. Index performance is for illustrative purposes only. You cannot invest directly in the index.

Chart description: Two bar charts side-by-side highlighting the decrease in money market fund returns after a peak in interest rates. The left chart represents the period from March 2001 to July 2002, and the right chart reflects the period from October 2007 to January 2009. A text callout is shown on each chart, highlighting the higher average annualized return of bonds compared with money market funds over these two periods.

Investors interested in putting idle cash to work may consider these short-term bond ETFs:

- The iShares 0-3 Month Treasury Bond ETF (SGOV) invests in U.S. Treasury bonds with remaining maturities less than or equal to three months.

- The higher income by investing in a broad range of fixed and floating rate bonds with an overall duration of less than three years

- The iShares 1-5 Year Investment Grade Corporate Bond ETF (IGSB) holds corporate bonds rated BBB or higher with remaining maturities between one and five years.

- iShares iBonds ETFs – iBonds are ETFs that mature like a bond, trade like a stock and diversify like a fund. iBonds intend to mature in the calendar year of the fund’s name. iShares iBonds Dec 2028 Term Corporate ETF (IBDT) holds over 650 investment grade corporate bonds and matures in December 2028.

How to use bonds in your portfolio

The main roles of fixed income investments are:

- Boost income potential: Rather than rely solely on capital appreciation to grow your portfolio, bonds can help provide regular income as an important source of return. Even U.S. Treasury bonds are now yielding 3-4%, investment grade corporates 4-5% and high yield or emerging markets bonds 6-7%.5 This income can potentially be a consistent source of returns for portfolios.

- Equity market diversification: During rising rate environments, the goal of the Fed is to reduce inflation and one option to do so is raising interest rates, but rate hikes may trigger a recession or a stock market downturn. Bonds have generally tended to outperform when stocks decline6, since they pay a contractual rate of interest and a flight-to-quality may occur — meaning investors turn to less risky investments and cause the prices of Treasury bonds to increase (a bond’s price moves in the opposite direction of its yield).

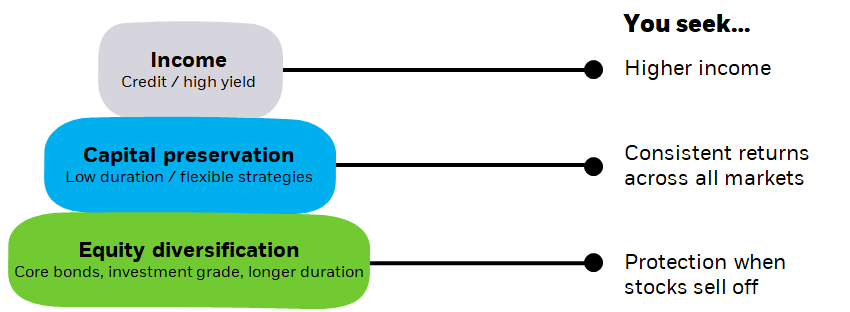

Bonds can potentially deliver 3 benefits

Source: BlackRock. This information should not be relied upon as research, investment advice or a recommendation regarding the funds or any security in particular. This information is strictly for illustrative and educational purposes and is subject to change.

Chart description: Illustration of the BlackRock Bond Pyramid, which shows the three key role bonds have historically played in portfolios.

Conclusion

Stepping out of cash and into the world of bond investing doesn’t have to be intimidating. Whether you are an experienced investor or reallocating to fixed income, the BlackRock Bond Pyramid shown above can help you think through the role of bonds. This framework articulates the purpose of bonds and can help you align your goals with bond investments. iShares bond ETFs offer over 140 funds to help investors pursue their fixed income goals and objectives.