KEY TAKEAWAYS

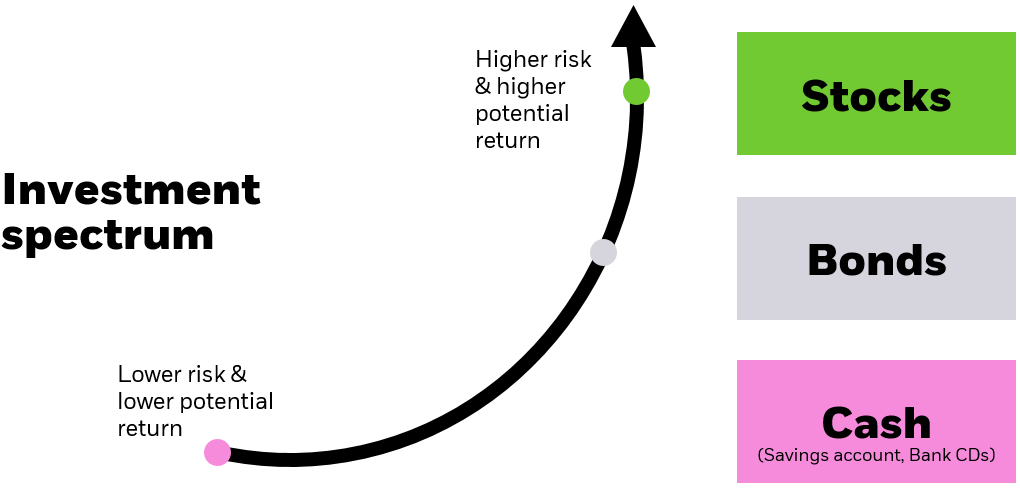

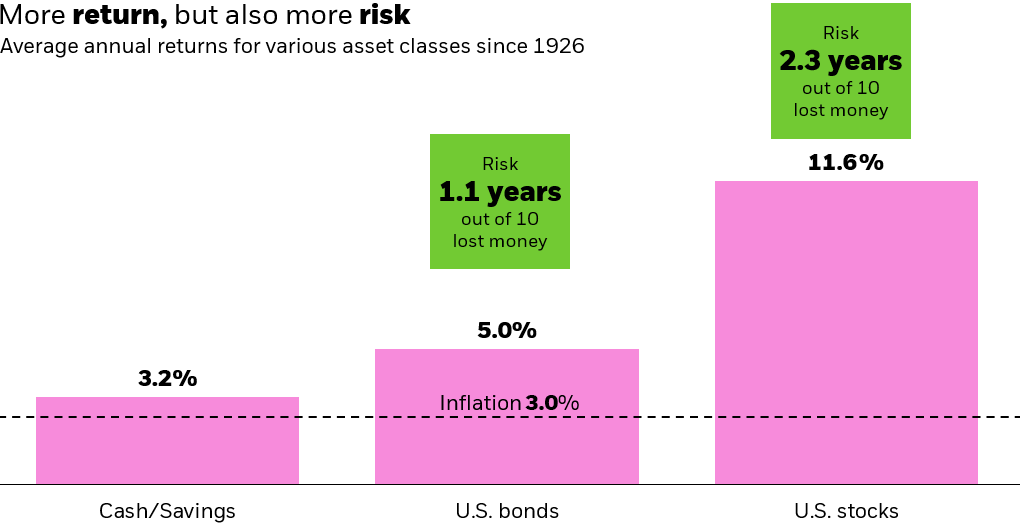

- Asset allocation is the mix of stocks, bonds and other assets in a portfolio.

- Determining the “right” asset allocation depends on personal circumstances such as age, investment objective, risk tolerance, and how much you have to invest.

- iShares Core asset allocation ETFs are designed to help investors build a diversified portfolio with one fund.

Asset allocation refers to the mix of stocks, bonds and other financial instruments in a portfolio. Deciding on your asset allocation is one of the most important decisions any investor makes. But how do you choose the breakdown of which assets — and how much — to put in a portfolio?