Updated: September 18, 2024

Bond duration demystified: A guide for fixed-income investors

Jun 20, 2024 Fixed Income

KEY TAKEAWAYS

- Duration is a way to measure the interest rate risk of a bond and is a critical factor in fixed income investing.

- Investors can manage their portfolio's duration through their selection of bonds or bond funds.

- iShares offers investors a wide range of fixed income ETFs to navigate various potential interest rate scenarios.

WHAT IS DURATION?

Duration is a way to measure the interest rate risk of a bond and is a critical factor in fixed income investing. Duration is defined as the change in value of a bond for a 1% change in interest rates. For example, if interest rates decrease by 1% and you own a 10-year bond with a duration of 5, then the price of that security is expected to increase by 5%. (Bond prices and bond yields generally are inversely related, meaning when yields increase, bond prices drop and vice versa.)

WHY BOND DURATION MATTERS TO INVESTORS

In balanced investment portfolios, stocks and bonds traditionally make up the basic building blocks. A classic “60-40” portfolio is comprised of 60% stocks and 40% bonds, which historically have served three key roles in portfolios: capital preservation, income generation, and diversification.

Bonds have the potential to deliver income via cash flows from coupon payments. These typically occur on a set schedule, which is why bonds are often referred to as “fixed income.” However, one of the biggest risks for bond investors comes from changes in interest rates. That’s why managing duration risk is so important to investors — especially in an environment like the one we’re in now.

MANAGING DURATION RISK IN THE CURRENT CYCLE

From March 2022 to July 2023, the Federal Reserve increased short-term interest rates (known as the fed funds rate) from 0.25% to a range of 5.25-5.50%. During that period, the broad U.S. bond market, as measured by the Bloomberg US Aggregate Bond Index, decreased by 8.8% — contributing to one of the worst 18-month periods in the history of the index.1

Going into 2024, market participants expected six Fed rate cuts, with the fed funds rate falling from 5.25% to 3.75%.2

However, at the June meeting of the Federal Open Market Committee, the U.S. central bank signaled it is cautious on reducing interest rates too soon as inflation still remains above the Fed's long-term targets.3 Then, at the September 18th meeting, the FOMC reduced the Fed funds target rate by 0.50% to 4.75-5.00%. The committee noted that they have “greater confidence that inflation is moving sustainably to the 2% target”.4

HOW TO THINK ABOUT DURATION RIGHT NOW

Bond investors can reduce duration — or interest rate risk — by selecting bonds or bond ETFs with short-term maturities, and they can increase their interest rate risk by selecting bonds or bond ETFs with longer maturities.

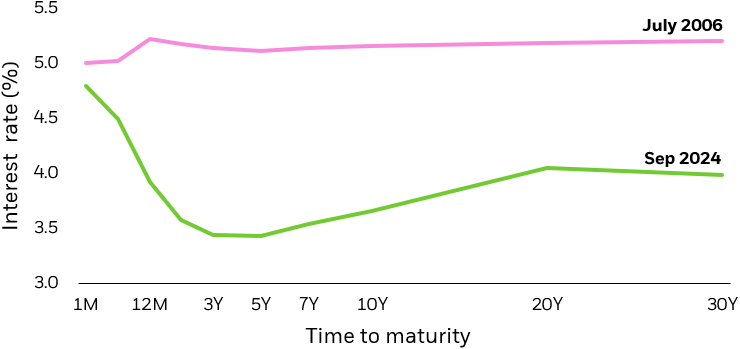

For most of 2024, longer-term interest rates have been lower than short-term term interest rates, a situation known as an inverted yield curve.5 The yield curve is a visualization of interest rates available at a specific point in time on bonds with the same credit quality — such as U.S. Treasuries — but with different maturity dates.

Typically, longer-term yields are higher than those of bonds with shorter maturities. This compensates investors for the risk of holding bonds for a longer period, as more time equals more uncertainty about the future path of inflation and interest rates. (For example, no one could have predicted the inflation spike in 2020–22 amid the COVID-19 pandemic and Russia’s invasion of Ukraine; both disrupted global trade and led to shortages of some items.)

The 2022–2024 yield curve inversion was a reflection that the market expects short-term rates to decline in the future, so longer-term rates are lower. What’s unusual about this inversion is that it lasted 27 months, ending in September 2024. Previous inversions in 2000 and 2006 lasted 10 months and six months, respectively.6 This ongoing, long-lasting inversion is occurring as the market thinks the Fed will be successful at bringing inflation down. The September FOMC statement projects the median rate to be 4.4% by the end of 2024 and a range of 3.1% – 3.6% by the end of 2026. The Fed’s Summary of Economic Projections also projects the federal funds rate to converge to 2.75% over a long-term time frame.7

We anticipate that the yield curve will revert to short-term rates being lower than longer-term rates, known as a normalization of term structure, eventually resulting in an upward sloping yield curve. While short rates should eventually decline with Fed cuts, we think rates on the long end of the yield curve will instead be driven by investors expecting more yield for longer maturities. (Read more about our views on current opportunities in bonds.)

Figure 1: US Treasury Bond yield curve

Pause periods 2006 and 2024

Source: Bloomberg using the current US treasury bond yields at each maturity point on July 3, 2006, and September 18, 2024.

Chart description: Line chart illustrating the U.S. Treasury Bond yield curve during two Federal Reserve pause periods: one concluding in 2006 and the other in 2024.

NAVIGATING DIFFERENT DURATION SCENARIOS

While daily changes in interest rates at different points are hard to predict, bond portfolios can be adjusted to take into account potential longer-term trends. Many investors use the broad US bond indices as the benchmark when determining how much interest rate risk to hold. The Bloomberg US Aggregate Bond Index has a duration of about 6 years.8 Investors can add or reduce duration relative to this commonly used bond index.

However, equity heavy portfolios may want to hold more interest rate risk, which can add diversification to stock portfolios. Very bond heavy portfolios (over 60%) many want to hold less duration if they are focused on capital preservation and do not want to add risk that rising interest rates may pose. Additionally, interest rates do not always move in parallel, so different interest rate environments could call for adjustments to holdings.

Here is a summary of five interest rate scenarios and potential strategies for managing bond portfolios with iShares bond ETFs.

Using iShares to navigate changing interest rate environments

| Interest rate scenario | Potential strategies | iShares bond ETFs |

|---|---|---|

| Rate cut ★ Current environment |

| AGG iShares Core U.S. Aggregate Bond ETF GOVT iShares U.S. Treasury Bond ETF SHY iShares 1-3 Year Treasury Bond ETF |

| Longer-term rates fall quickly |

| TLT iShares 20+ Year Treasury Bond ETF GOVZ iShares 25+ Year Treasury STRIPS Bond ETF IGLB iShares 10+ Year Investment Grade Corporate Bond ETF |

| Pause or rates unchanged |

| AGG iShares Core U.S. Aggregate Bond ETF IEI iShares 3-7 Year Treasury Bond ETF BINC iShares Flexible Income Active ETF |

| Longer-term rates rise quickly |

| HYGH iShares Interest Rate Hedged High Yield Bond ETF AGRH iShares Interest Rate Hedged U.S. Aggregate Bond ETF LQDH iShares Interest Rate Hedged Corporate Bond ETF IGBH iShares Interest Rate Hedged Long-Term Corporate Bond ETF |

| Rate hike |

| TFLO iShares Treasury Floating Rate Bond ETF FLOT iShares Floating Rate Bond ETF NEAR iShares Short Duration Bond Active ETF |

For illustrative purposes only.

* A “flight to quality” refers to investors’ allocating assets from riskier assets to assets seen as safer and higher in quality.