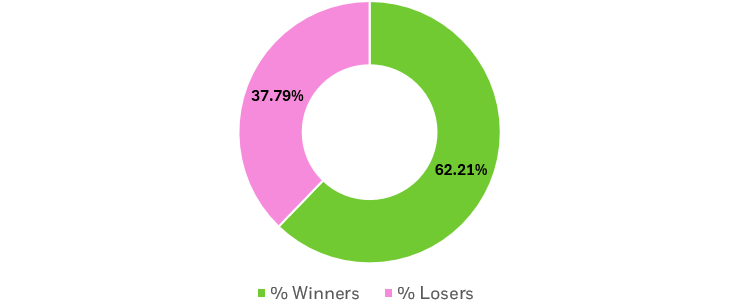

So equity investors have done great but only if they were in the right stocks. In other words, it’s been very possible to experience meaningful losses in a winning market, which shows the importance of diversification in investing.

And while past performance doesn’t guarantee future returns, shares of the 20 largest publicly traded U.S. companies contributed 60% of the S&P 500’s total return over the last five-years.3 The iShares Top 20 U.S. Stocks ETF (TOPT), which launched on Oct. 24, 2024, empowers investors to access 20 of the biggest and some of the most successful companies in the U.S. with a single trade, via the convenience of the low-cost and tax-efficient ETF wrapper.

The iShares Top 20 U.S. Stocks ETF seeks to track the investment results of an index comprised of the 20 largest U.S. companies by market capitalization within the S&P 500 Index. Market cap is the dollar value of a company’s total outstanding shares of public stock. If, for example, a company has 100 million shares of stock outstanding and it trades at $100 per share, its market cap would be $1 trillion.

Market capitalization is often used as a way to measure the size of a company, and as a way to differentiate between companies. For instance, companies are typically categorized as being large-, mid- or small-cap based on their market capitalization.

Brands currently in the top 20 by market cap include Apple, Amazon, Meta, Johnson & Johnson and JP Morgan Chase. The 20 largest publicly traded U.S. stocks collectively represent $22.6 trillion in market cap, almost equal to the size of the U.S. economy, which produced approximately $25 trillion of GDP in the first quarter of 2024.4

These companies operate in more than 160 countries around the world and currently employ about 4.4 million Americans.5