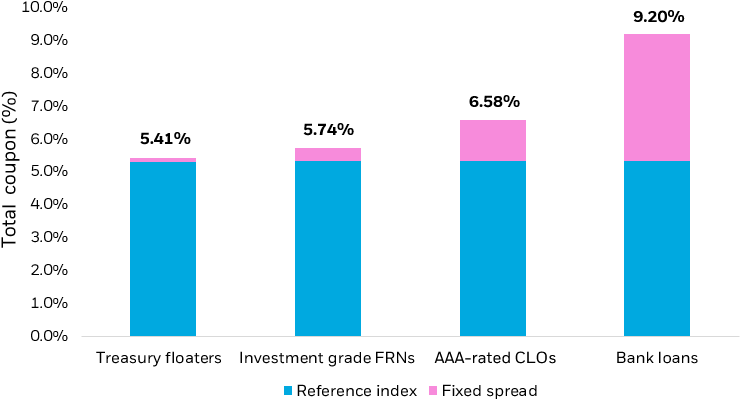

The income paid by floating rate securities is the result of the floating rate plus a fixed spread. The fixed spread is determined at the time of issuance based on demand for the security and the market’s perception of the issuer’s credit risk. Historically, the higher the credit risk, the higher the fixed spread. The coupons typically reset quarterly and are paid quarterly or semi-annually.

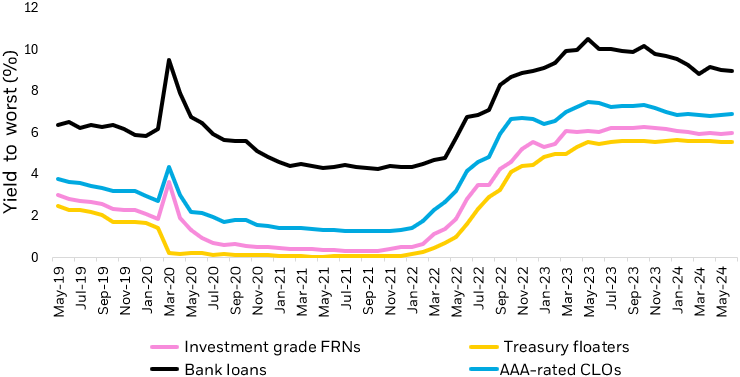

Coupons reset quarterly to protect investors from interest rate fluctuations. The reset allows the coupon rate to adjust to the current market conditions, ensuring that the investment yields returns are in line with the prevailing interest rates. The quarterly reset is common because it strikes a balance between providing investors with some stability in their interest payments while still allowing for regular adjustments to reflect market changes.

Coupon = reference index (SOFR ) + fixed spread

Today, investors have access to a broad spectrum of floating rate ETFs, including those that hold U.S. Treasury floating rate notes, investment grade corporate floating rate bonds, high yield floating rate bank loans, and AAA-rated collateralized loan obligations (CLOs).

Currently, U.S. Treasury floating rate notes have a fixed spread of 0.11%. Meanwhile, investment grade floaters may have a spread of 0.41%, AAA-rated CLOs may have 1.25% and bank loans around 3.87% as of June 30, 2024. Figure 1 below provides a coupon breakdown for each of these instruments: