If you want to invest, but don’t want to make investing your full-time job, target date funds can take the guesswork out of retirement investing. Rather than deciding how much to allocate to stocks, bonds or commodities, buying a target date fund lets you set a target date and the fund automatically manages risks around it.

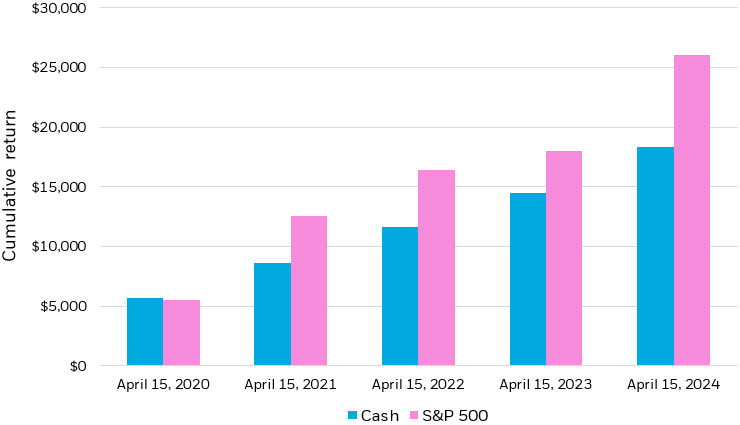

In practice, that means that the longer investment horizon, the higher the share of stocks in the portfolio. While stocks have recently generated positive returns (to the tune of 12% annually, over the last ten years), those rewards are not without risk.3 In 2022, for example, equity markets dipped nearly 20% as aggressive monetary policy, the Russia-Ukraine conflict, and recession fears halted a three-year streak of positive gains.4

If the year an investor needs cash happens to align with a steep market pullback, years of returns can be wiped out. But target date funds can guide outcomes with more reasonable certainty by adjusting the mix of stocks and bonds as the target date approaches. This can help dampen the impact of big short-term moves in price action. For investors eyeing their golden years, target date ETFs can be an important tool to getting there in style.