Investing for retirement can feel daunting but it can also be fun. Estimating how much you need to save for retirement requires each of us to do some daydreaming.

You can ask yourself questions like: What do you want your retirement to look like? How do you plan to spend your time in retirement? Where do you want to live?

Everyone has a different vision of what they want their retirement to look like. Whether you want to travel, volunteer, focus on family and friends, or spend time on hobbies will impact how much you're going to need to save.

After envisioning what you’d like retirement to look like, it’s time to turn your attention to your investments, and the steps you can take to help assure you retire comfortably.

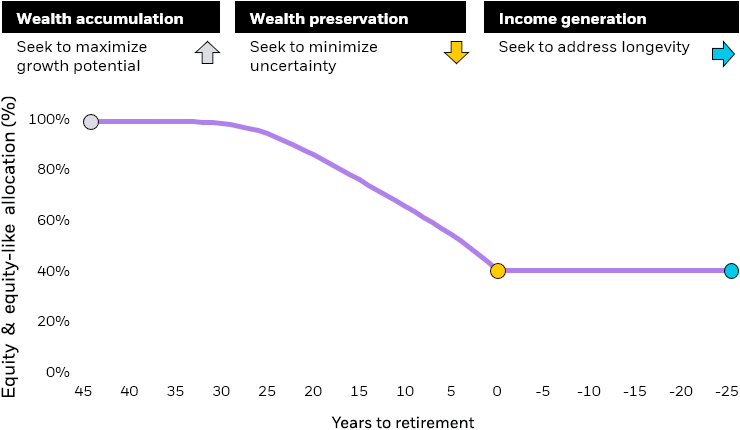

Integral to investing for retirement is understanding your risk tolerance. While everyone’s risk tolerance is unique, there are three general phases in a financial journey that most of us travel through on the path to retirement.