Updated: June 5, 2024

MINIMUM VOLATILITY 101: THE BASICS AND ITS ROLE IN PORTFOLIOS

May 19, 2023 Factors

KEY TAKEAWAYS

- Minimum Volatility investing seeks to reduce risk by investing in a portfolio of stocks that exhibits less volatility than the broad market.

- Minimum Volatility investing has been around for decades and is supported by economic theory and empirical data.1

- Minimum Volatility strategies consider individual stock price fluctuations, as well as how the stocks interact with each other, to build a portfolio with less risk than the broad market.

WHAT IS MINIMUM VOLATILITY INVESTING?

Minimum volatility investing seeks to build a portfolio of stocks that exhibits less variability than the broad market. It aims to provide investors with a smoother ride within equity allocations by creating a portfolio that exhibits less swings — up or down — than the market.

Imagine that you’re a hiker who has two potential paths to climb a mountain. One trail is very challenging. It’s steep, rocky, and has several parts where the path has sharp descents. While the trail is exhilarating, there is also the increased risk of injury or falling. Alternatively, there is a second trail that is more gradual and stable. While this trail may be less exciting, there is a much lower chance of getting injured or hurt.

In this analogy, a minimum volatility strategy would look more like the second trail — less risky and designed to be more stable. A min vol portfolio can help investors navigate the risks of big fluctuations in the market. Just as hikers can still reach the summit of the mountain on a less challenging trail, investors can still pursue their investment goals while seeking to avoid stomach churning volatility.

HOW DO WE DEFINE MINIMUM VOLATILITY INVESTING?

BlackRock specifically looks at individual stock volatility and correlations when evaluating a minimum volatility portfolio.2

BlackRock’s approach to minimum volatility investing

| Statistic | Objective |

|---|---|

| Stock Volatility | Identify how volatile an individual stock has been based on standard deviation³ |

| Correlations | Understand how stocks move relative to each other based on several factors⁴ |

Source: BlackRock, MSCI

Minimum volatility investing looks to build a portfolio with less risk than the broad market– not just a collection of less risky stocks. Rather than just buy the least volatile stocks in the market, minimum volatility also considers how the underlying stocks move relative to each other. Unlike the other factors we believe in at BlackRock, the primary goal of minimum volatility is to reduce overall risk in portfolios. Minimum volatility ETFs can be viewed as tools that investors can use in a long-term strategic asset allocation as a way to help lower the overall risk and stay invested. Historically, minimum volatility indexes have exhibited less volatility than their broad market counterparts.

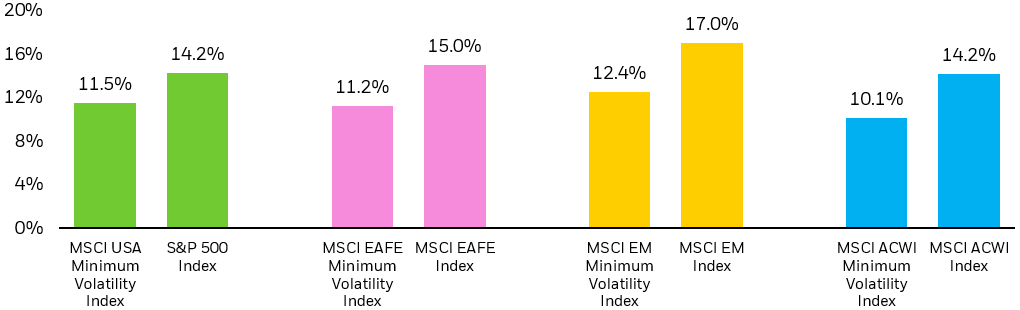

Annualized Risk (%)

Source: Morningstar as of 3/31/2024. Annualized Risk is defined by the standard deviation on the annualized returns of each of the Indexes respectively from 11/1/2011 - 3/31/2023. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Bar chart that shows annualized risk (as measured by the MSCI USA Minimum Volatility Index, MSCI EAFE Minimum Volatility index, MSCI EM Minimum Volatility Index, MSCI ACWI Minimum Volatility Index) vs the respective market (as represented by the S&P 500 Index, MSCI EAFE Index, MSCI EM Index, MSCI ACWI Index). Data as of 11/1/11- 3/31/24.

The beauty of minimum volatility strategies is their ability to significantly reduce risk in portfolios while allowing investors to maintain dedicated equity exposure. This means investors can continue participating in equity rallies, unlike other asset classes that investors may pivot to in periods of market turbulence, such as fixed income or cash.

As a bonus, from a performance perspective, research has found that more volatile stocks have historically had lower realized returns than less volatile stocks.5 As my colleague Andrew Ang noted in his seminal paper, “The Cross-Section of Volatility and Expected Returns,” stocks with higher idiosyncratic volatility have “abysmally low average returns.” By design, more volatile stocks are more likely to be excluded in minimum volatility portfolios.

MINIMUM VOLATILITY PORTFOLIO CONSTRUCTION

One question investors sometimes ponder — do minimum volatility funds essentially just buy a bunch of consumer staples and utility companies? Am I better off just buying a sector fund that invests in only consumer staples stocks?

The MSCI Minimum Volatility Indexes, which the suite of iShares Min Vol ETFs seeks to track, explicitly apply sector gates at +/- 5% relative to the sector weights in the underlying parent indexes at each rebalance.6 This constraint was purposely applied to help prevent unintended overweights to “safe haven” sectors. This sector-controlled approach makes minimum volatility attractive as a core position in a portfolio.

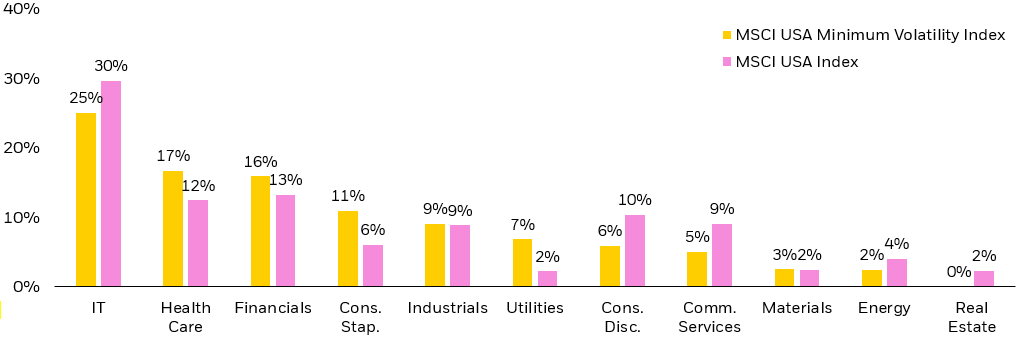

Sector Weights (%)

Source: BlackRock as of as of 3/31/2024. The parent index of the MSCI USA Minimum Volatility Index is the MSCI USA Index. Indexes are unmanaged and one cannot invest directly in an index. Past performance does not guarantee future results.

Chart description: Bar chart that compares the sector weights between the MSCI USA Index, and the MSCI USA Minimum Volatility Index as of 3/31/24.

As highlighted in the chart above, minimum volatility tends to naturally overweight the utilities and consumer staples sectors; however, the sector caps play an important role in helping min vol seek to capture more upside on a relative basis, if equity markets rally.

Factors, such as minimum volatility, have historically provided enhanced returns and/or reduced risk. Sectors are a source of unrewarded, active risk in portfolios. We prefer investing in minimum volatility, rather than unintended sector bets.

WHAT DOES MIN VOL DO FOR YOU?

Min vol has persistently lowered risk in portfolios when compared to the broad market. In fact, MSCI USA Minimum Volatility Index has had ~20% less volatility than the S&P 500 Index since inception.7 Investors can use minimum volatility strategies to provide ballast in their portfolios and allow them to stay invested during periods of market turmoil.

Historically, academic research has also found that less volatile stocks have outperformed their more volatile peers over time.8 Several theories have been posed to explain the historical outperformance. For example, many institutional investors have high return targets that they seek to reach. Some of these investors are structurally prohibited from using leverage in their portfolios. In order to reach their high return targets, they end up overweighting more volatile companies, hoping to capture more of the equity premium. This may have led to a persistent, systematic underweight to less volatile companies.

Another explanation could be that some investors seek stocks with the potential for a high payout. Sometimes referred to as the “lottery effect,” there may be groups of investors that are willing to overpay for these companies that have a small probability of generating high returns. Typically, these companies are riskier, more volatile securities. The preference for the potential of a large return, may have also led to a persistent underappreciation of less volatile stocks.

CONCLUSION

Asset allocation and staying fully invested in equity markets are often two key drivers of portfolio performance. But time and time again, we see many cases where even the most disciplined investors can abandon their plan when volatility rises, and markets sell off. We believe minimum volatility funds, such as the iShares MSCI USA Minimum Volatility Factor ETF (Ticker: USMV), the iShares MSCI EAFE Minimum Volatility Factor ETF (Ticker: EFAV), and the iShares MSCI Emerging Markets Minimum Volatility Factor ETF (Ticker: EEMV) may help investors stick with their long term plans and reach their financial goals.